Insights on the Progressive Lenses Global Market to 2027 - Key Players Include ZEISS, EssilorLuxottica, HOYA and Shamir

Progressive Lenses Market

Dublin, Jan. 05, 2023 (GLOBE NEWSWIRE) -- The "Progressive Lenses Market - Global Outlook & Forecast 2022-2027" report has been added to ResearchAndMarkets.com's offering.

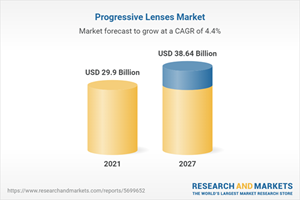

The global progressive lenses market is expected to grow at a CAGR of 4.37% during 2021-2027. The market plays an important role in restoring multiple vision dysfunctions, including refractive errors such as myopia, hyperopia, astigmatism, and presbyopia. The clinical aspect of vision care involves the prevention of eye diseases as well as temporary and complete vision correction. The demand for eye care products in the global progressive lenses market is continually increasing with the growing prevalence of visual dysfunctions in developed and developing countries.

Progressive lenses are multifocal lenses specifically for people needing corrective lenses to see distant and close objects. These lenses allow you to see clearly at multiple distances without a bifocal line. The need for a progressive lens increases with age. By age 35 or 40, many people have difficulty focusing their eyes on nearby or distant objects.

This condition is known as refractive error, and to compensate for this focusing problem, some people wear single-vision eyeglasses for distance and reading glasses for close. Eyeglasses come in a variety of types. This includes a single-vision lens with one power or strength over the entire lens or a bifocal or trifocal lens with multiple strengths over the entire lens. But multifocal lenses are designed with different prescription areas.

As people age, the ability to see near and far objects may decline. The progressive lenses market meets different visual needs in one lens. Usually, the top of the lens incorporates the 'distance' field of view and the bottom the 'near' field of view. Rather than separating the lines that separate these areas, progressive lenses are blended so that the central portion of the lens acts as intermediate vision correction when needed. In contrast to traditional bifocal or trifocal lenses, no visible lines separate the different fields in progressive lenses. Compared to bifocal lenses, progressive lenses can protect the neck and posture.

The acceptance in the progressive lenses market was mainly concentrated in developed countries such as the U.S., Japan, the UK, Germany, and France. However, developing Asian countries such as India and China are witnessing increased demand for progressive lenses owing to the growing target population with refractive error and visual impairment eye disorders and aggressive retail optical stores marketing campaigns.

MARKET TRENDS & OPPORTUNITIES

Growing prevalence of computer vision syndrome (CVS)

According to the Vision Council, at least 60% of American men and 65% of American women report CVS symptoms, 80% of adults use digital devices for more than two hours a day, and more than 65% of adults use at least two devices at the same time. About 80% of adults use a digital device before bedtime, and at least 70% of adults report that their child spends at least two hours of screen time. Simultaneous use of 2 or more devices increased the risk of CVS compared to the use of 1 device at a time; the reported prevalence was 75 % and 53 %, respectively. Over the last few years, there has been a significant increase in the average number of hours spent accessing and consuming digital content, resulting in the rise of eye disorders are driving the global progressive lenses market growth.

The Emergence Of Digital Progressive Lenses And Technological Advancements

Digital lenses are ideal for many progressive spectacle wearers, especially with the latest algorithms used to surface these lenses. These advanced progressive designs have many advantages over standard progressive lenses as the Progressive lenses are slightly improved with each advancement released. Manufacturers have developed different concepts for new progressive lens technology in the progressive lens market. While some manufacturers require technical equipment to collect biometric data on the corneal shape to optimize the cornea further, others offer a broader range of products rather than highly specialized ones.

Rise of E-commerce as a Preferred Distribution Channel

The rise in e-commerce as a distribution channel has contributed to the growing global demand for vision care products in the progressive lenses market. The internet plays a broader role as a supplier of consumer information & providing a platform for price referencing. For vision care products like progressive lenses, channel consolidation is rising and vertically combined. The vendors are developing an automated ordering system to allow users to order progressive lenses online, which will positively affect everyone involved in the practice.

Revolution of 3D Printed Progressive Lenses

3D printing is currently changing the way eyewear is designed and manufactured. Many eyewear manufacturers and even individuals have started adopting this layer-by-layer technology primarily to differentiate their products from their competitors and bring further innovation to eyewear design in the global progressive lenses market. But 3D printing technology also opens new possibilities for eyewear companies. 3D-printed lenses can have multiple zones with different optical properties. As a result of using Additive Manufacturing, all that has to be done is to design a 3D model much faster than traditional lens-making techniques.

Growing Prevalence of Refractive Errors and the Increasing Geriatric Population

Globally, around 285 million people have impaired vision, and more than 80% of the impaired vision cases are preventable with early diagnosis and treatment. As the world population ages, the need for quality vision care is expanding and evolving, with the availability of a diverse range of progressive lenses for several vision impairments boosting the progressive lenses market. The geriatric population is growing rapidly in several regions worldwide. The rapidly increasing elderly population is linked to the increase in chronic diseases, including eye disorders.

COMPETITIVE LANDSCAPE

The global progressive lenses market is an oligopoly market with international, regional, and local players offering various products. The leading players in the progressive lenses market are ZEISS, EssilorLuxottica, HOYA, and Shamir. The competition is intense among tier I/II vendors as many local players are available in the market in every country and pose a significant threat to regional and global players.

In recent years, the global eyeglasses market has witnessed many strategic initiatives by key and prominent vendors, intensifying market competitiveness. The strategic merger of major Essilor and Luxottica Group resulted in the formation of EssilorLuxottica, thereby increasing the merged entity's market share significantly over that of its competitors. Vendors compete based on product variety, pricing, quality, technological leadership and innovation, and the efficacy of progressive lenses.

Key Vendors

ZEISS

EssilorLuxottica

HOYA

Shamir

Other Prominent Vendors

BBGR

Fielmann

Indo Optical SLU

JIANGSU HONGCHEN OPTICAL

Leica Eyecare

Nikon Optical

Optimum RX Group

Optiswiss

optoVision

Prime Lenses

Rodenstock

RUPP & HUBRACH GLASSES

Seiko Optical Products

Shanghai Conant Optics

Signet Armorlite

Tokai Optical

Vision Ease

Yash Optics And Lens

Younger Optics

KEY QUESTIONS ANSWERED

1. What is the size of the global progressive lenses market?

2. What is the growth rate of the global progressive lenses market?

3. What factors impact the growth of the progressive lenses market?

4. Who are the key players in the global progressive lenses market?

5. Which region has the highest progressive lenses market share globally?

Report Attribute | Details |

No. of Pages | 323 |

Forecast Period | 2021 - 2027 |

Estimated Market Value (USD) in 2021 | $29.9 Billion |

Forecasted Market Value (USD) by 2027 | $38.64 Billion |

Compound Annual Growth Rate | 4.3% |

Regions Covered | Global |

Key Topics Covered:

1 Research Methodology

2 Research Objectives

3 Research Process

4 Scope & Coverage

4.1 Market Definition

4.1.1 Inclusions

4.1.2 Exclusions

4.1.3 Market Estimation Caveats

4.2 Base Year

4.3 Scope of the Study

4.3.1 Market by Material Segmentation

4.3.2 Market by Application Segmentation

4.3.3 Market by Age Group Segmentation

4.3.4 Market by Distribution Channel Segmentation

4.3.5 Market Segmentation by Geography

5 Report Assumptions & Caveats

5.1 Key Caveats

5.2 Currency Conversion

5.3 Market Derivation

6 Market at a Glance

7 Premium Insights

8 Introduction

8.1 Overview

9 Market Opportunities & Trends

9.1 Evolution of 3D-Printed Progressive Lenses

9.2 Advances in Progressive Lens Technologies

9.3 Focus on Omnichannel Distribution Approach

10 Market Growth Enablers

10.1 High Prevalence of Refractive Errors

10.2 Rise in Exposure to Digital Content & Cvs

10.3 Public and Private Initiatives to Increase Vision Care Awareness

11 Market Restraints

11.1 Limitations of Progressive Lenses

11.2 Rise in Lasik Procedures for Vision Correction

11.3 Emergence of Smart Contact Lenses

12 Market Landscape

12.1 Market Overview

12.2 Market Size & Forecast

12.2.1 Geography Insights

12.2.2 Material Segmentation Insights

12.2.3 Applications Segmentation Insights

12.2.4 Age Group Segmentation Insights

12.2.5 Distribution Channel Segmentation Insights

12.3 Five Forces Analysis

13 Material

14 Application

15 Age Group

16 Distribution Channel

17 Geography

18 Europe

19 APAC

20 North America

21 Latin America

22 Middle East & Africa

23 Competitive Landscape

23.1 Competition Overview

23.2 Market Share Analysis

23.2.1 Zeiss

23.2.2 Essilorluxottica

23.2.3 Hoya

23.2.4 Shamir

24 Key Company Profiles

24.1 Zeiss

24.1.1 Business Overview

24.1.2 Product Offerings

24.1.3 Key Strategies

24.1.4 Key Strengths

24.1.5 Key Opportunities

24.2 Essilorluxottica

24.2.1 Business Overview

24.2.2 Product Offerings

24.2.3 Key Strategies

24.2.4 Key Strengths

24.2.5 Key Opportunities

24.3 Hoya

24.3.1 Business Overview

24.3.2 Product Offerings

24.3.3 Key Strategies

24.3.4 Key Strengths

24.3.5 Key Opportunities

24.4 Shamir

24.4.1 Business Overview

24.4.2 Product Offerings

24.4.3 Key Strategies

24.4.4 Key Strengths

24.4.5 Key Opportunities

25 Other Prominent Vendors

25.1 Bbgr

25.1.1 Business Overview

25.1.2 Product Offerings

25.2 Fielmann

25.2.1 Business Overview

25.2.2 Product Offerings

25.3 Indo Optical Slu

25.3.1 Business Overview

25.3.2 Product Offerings

25.4 Jiangsu Hongchen Optical

25.4.1 Business Overview

25.4.2 Product Offerings

25.5 Leica Eyecare

25.5.1 Business Overview

25.5.2 Product Offerings

25.6 Nikon Optical

25.6.1 Business Overview

25.6.2 Product Offerings

25.7 Optimum Rx Group

25.7.1 Business Overview

25.7.2 Product Offerings

25.8 Optiswiss

25.8.1 Business Overview

25.8.2 Product Offerings

25.9 Optovision

25.9.1 Business Overview

25.9.2 Product Offerings

25.10 Prime Lenses

25.10.1 Business Overview

25.10.2 Product Offerings

25.11 Rodenstock

25.11.1 Business Overview

25.11.2 Product Offerings

25.12 Rupp & Hubrach Glasses

25.12.1 Business Overview

25.12.2 Product Offerings

25.13 Seiko Optical Products

25.13.1 Product Offerings

25.14 Shanghai Conant Optics

25.14.1 Business Overview

25.14.2 Product Offerings

25.15 Signet Armorlite

25.15.1 Business Overview

25.15.2 Product Offerings

25.16 Tokai Optical

25.16.1 Business Overview

25.16.2 Product Offerings

25.17 Vision Ease

25.17.1 Business Overview

25.17.2 Product Offerings

25.18 Yash Optics and Lens

25.18.1 Business Overview

25.18.2 Product Offerings

25.19 Younger Optics

25.19.1 Business Overview

25.19.2 Product Offerings

26 Report Summary

27 Quantitative Summary

28 Appendix

For more information about this report visit https://www.researchandmarkets.com/r/dfnd8c

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance