Insperity (NSP) Up on Worksite Employees Growth, Expenses Ail

Insperity, Inc. NSP shares have had an impressive run on the bourses over the past year. The stock has appreciated 53.7% over the past year, outperforming the 52.7% rise of the industry it belongs to.

The company recently reported third-quarter 2021 adjusted earnings of 89 cents per share, which beat the Zacks Consensus Estimate by 6% but decreased 2.2% year over year. Revenues of $1.21 billion surpassed the consensus mark by 3.5% and increased 20% year over year.

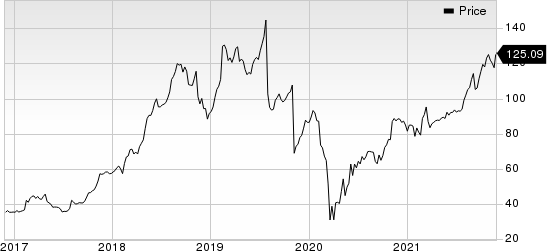

Insperity, Inc. Price

Insperity, Inc. price | Insperity, Inc. Quote

How is Insperity Doing?

Insperity’s top-line growth is directly proportional to the rise in the average number of worksite employees paid per month. In third-quarter 2021, revenues grew 20% year over year on the back of 8% increase in revenues per worksite employees (WSEEs) and 11% increase in paid worksite employees. The average number of worksite employees paid per month, 257,560, inched up 11.1% year over year. Worksite employee growth is being driven by strength across sales, higher client retention and rise in net hiring of worksite employees by the company’s client base.

Insperity, being an integrated human resources and business solutions provider, offers a comprehensive suite of HR services solutions through professional employer organization (“PEO”) services known as Workforce Optimization and Workforce Synchronization solutions. With the help of these solutions, Insperity serves small- and medium-sized businesses in select markets throughout the United States. Apart from PEO services, Insperity is also focusing on its Workforce Administration solution that provides human capital management and payroll services solutions. Additional offerings of the company include time and attendance, organizational planning, recruiting services, employment screening, performance management, retirement services as well as insurance services.

Insperity is seeing an increase in expenses as it continues to invest in growth, technology, and product and service offerings. During third-quarter 2021, operating expenses of $490.83 million increased 8.5% year over year.

Zacks Rank and Stocks to Consider

Insperity currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some other top-ranked stocks in the broader Business Services sector are Avis Budget CAR and Cross Country Healthcare (CCRN), both sporting a Zacks Rank #1, and Charles River Associates (CRAI), carrying a Zacks Rank #2 (Buy).

Avis Budget has an expected earnings growth rate of 420.6% for the current year. The company has a trailing four-quarter earnings surprise of 76.9%, on average.

Avis Budget’s shares have surged 744.3% in the past year. The company has a long-term earnings growth of 18.8%.

Cross Country Healthcare has an expected earnings growth rate of 447.8% for the current year. The company has a trailing four-quarter earnings surprise of 75%, on average.

Cross Country Healthcare’s shares have surged 201% in the past year. The company has a long-term earnings growth of 21.5%.

Charles River Associates has an expected earnings growth rate of 61.2% for the current year. The company has a trailing four-quarter earnings surprise of 51%, on average.

Charles River’s shares have surged 119.3% in the past year. The company has a long-term earnings growth of 15.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Insperity, Inc. (NSP) : Free Stock Analysis Report

Cross Country Healthcare, Inc. (CCRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance