Inspired Energy PLC (LON:INSE) P/E Isn't Throwing Up Surprises

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

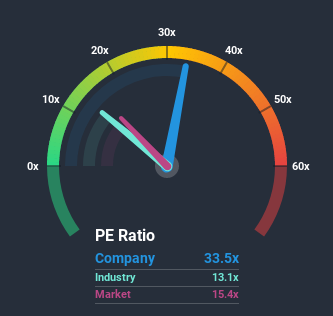

When close to half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") below 15x, you may consider Inspired Energy PLC (LON:INSE) as a stock to avoid entirely with its 33.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

For instance, Inspired Energy's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Inspired Energy

Does Inspired Energy Have A Relatively High Or Low P/E For Its Industry?

It's plausible that Inspired Energy's particularly high P/E ratio could be a result of tendencies within its own industry. You'll notice in the figure below that P/E ratios in the Commercial Services industry are lower than the market. So it appears the company's ratio isn't currently influenced by these industry numbers whatsoever. Ordinarily, the majority of companies' P/E's would be compressed by the general conditions within the Commercial Services industry. Still, the strength of the company's earnings will most likely determine where its P/E shall sit.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Inspired Energy's earnings, revenue and cash flow.

What Are Growth Metrics Telling Us About The High P/E?

Inspired Energy's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 33% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to decline by 15% over the next year, even worse than the company's recent medium-term annualised earnings decline.

With this information, it might not be hard to see why Inspired Energy is trading at a higher P/E in comparison. However, even if the company's recent growth rates were to continue outperforming the market, shrinking earnings are unlikely to make the P/E premium sustainable over the longer term. There is potential for the P/E to fall to lower levels if the company doesn't improve its profitability, which would be difficult to do with the current market outlook.

The Final Word

The price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Inspired Energy maintains its high P/E on the strength of its recentthree-year earnings not being as bad as the forecasts for a struggling market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under any additional threat. We still remain cautious about the company's ability to stay its recent course and resist the broader market turmoil. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

Having said that, be aware Inspired Energy is showing 3 warning signs in our investment analysis, you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance