Installed Building (IBP) Tops on Q1 Earnings & Net Revenues

Installed Building Products, Inc. IBP reported impressive first-quarter 2024 results. Both earnings and net revenues surpassed the Zacks Consensus Estimate and increased on a year-over-year basis.

Installed Building’s shares gained 2.1% during the trading session on May 9, following the earnings release.

The first-quarter financial results of IBP showcase enhancements in the single-family end market and sustained robust sales growth in the multi-family end market. Customers demonstrate a strong commitment to constructing single-family homes amidst the current macroeconomic and industry conditions. Additionally, the long-term prospects in both residential and commercial end markets remain highly promising.

Inside the Headlines

Installed Building reported adjusted earnings per share (EPS) of $2.47 per share, which topped the Zacks Consensus Estimate of $2.23 by 10.8%. The metric also grew 14.9% year over year.

Net revenues of $692.9 million topped the consensus mark of $677 million by 2.4% and increased 5.1% year over year. On a same-branch basis, net revenues grew 2.9% from the prior year. This rise was mainly driven by a 3.8% improvement in price/mix, although partially offset by a 1.4% decrease in IBP's reported job volume.

In the quarter, residential sales growth in the company's Installation segment reached 3.8% when measured on a same-branch basis. This increase stemmed from a 1.5% rise in single-family same-branch sales coupled with a notable 13% surge in multi-family same-branch sales.

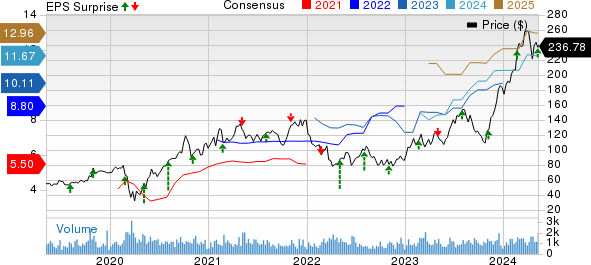

Installed Building Products, Inc. Price, Consensus and EPS Surprise

Installed Building Products, Inc. price-consensus-eps-surprise-chart | Installed Building Products, Inc. Quote

Segmental Performance

Installation (which accounted for 94.7% of total net sales): The segment’s net revenues came in at $655.9 million, up 5.3% year over year, driven by growth in both single-family and multi-family sales, as well as contributions from recent acquisitions by IBP. The segment’s gross margin improved 200 basis points (bps) year over year to 36.1%.

Other (5.8%): The segment’s net revenues, including IBP’s manufacturing and distribution operations, rose 1.1% year over year to $37 million. The segment’s gross margin improved 280 bps year over year to 29.3%.

Operating Highlights

Gross profit increased 11.5% year over year to $234.5 million. Gross margin expanded 200 bps year over year to 33.9%.

Adjusted EBITDA improved 11.6% year over year to $117.3 million. Adjusted EBITDA margin expanded 100 bps to 16.9% from the year-ago figure.

Financials

As of Mar 31, 2024, Installed Building had cash and cash equivalents of $399.9 million compared with $386.5 million at 2023-end. Long-term debt at the first quarter of 2024-end was $843.4 million, up from $835.1 million at 2023-end.

Net cash provided by operations was $84.8 million in the quarter compared with $73.8 million in the year-ago period.

Zacks Rank & Recent Construction Releases

Installed Building currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

TopBuild Corp. BLD reported mixed results for first-quarter 2024, wherein its earnings topped the Zacks Consensus Estimate but revenues missed the same.

Nonetheless, BLD’s earnings and net sales grew on a year-over-year basis. Notably, effective price realization during the quarter, combined with productivity initiatives, resulted in a 100 basis points (bps) expansion of the adjusted EBITDA margin.

Owens Corning OC reported impressive results in first-quarter 2024, with earnings and net sales surpassing the Zacks Consensus Estimate. Earnings increased on a year-over-year basis despite a net sales decline. Sales declined due to lower sales volumes in the Insulation and Composites segments.

For the second quarter of 2024, Owens Corning expects net sales to be in line with the second quarter of 2023 while generating approximately 20% EBIT margins.

Masco Corporation MAS reported mixed results for first-quarter 2024, wherein earnings surpassed the Zacks Consensus Estimate, but net sales lagged the same. On a year-over-year basis earnings increased despite net sales decline.

Strong operational efficiency helped Masco deliver solid earnings. Masco’s focus on a balanced capital deployment strategy helped it return $212 million to shareholders via dividends and share repurchases.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Masco Corporation (MAS) : Free Stock Analysis Report

Owens Corning Inc (OC) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report

Installed Building Products, Inc. (IBP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance