Insulet (PODD) Q4 Earnings Lag Estimates, Revenues Beat

Insulet Corporation PODD announced fourth-quarter fiscal 2019 GAAP earnings per share (EPS) of 8 cents, down 50% year over year. The metric also missed the Zacks Consensus Estimate by a penny.

Full-year GAAP EPS was 19 cents, reflecting a 280% surge from 5 cents reported a year ago. However, the company beat the Zacks Consensus Estimate by a penny.

Revenues in Detail

Revenues in the fourth quarter totaled $209.4 million, beating the Zacks Consensus Estimate by 5.9%. Moreover, the top line jumped 26.9% from the year-ago number.

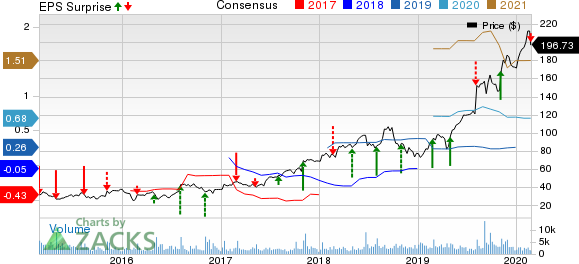

Insulet Corporation Price, Consensus and EPS Surprise

Insulet Corporation price-consensus-eps-surprise-chart | Insulet Corporation Quote

Full-year revenues were $738.2 million, reflecting a 30.9% increase from the year-ago period. Revenues beat the Zacks Consensus Estimate by 1.6%.

Segment in Detail

Insulet delivered fourth-quarter U.S. Omnipod revenues of $126.7 million, reflecting an increase of 36% year over year.

International Omnipod revenues of $65.8 million were up 20%.

The Drug Delivery business’ revenues totaled $16.9 million, up 1% year over year.

Margins

Gross profit in the reported quarter was $134.1 million, up 21.6% from the prior-year quarter. However, gross margin of 64% contracted 285 basis points (bps).

However, operating profit rose 12.3% to $18 million. Total operating expenses of $116 million escalated 23.2% from the year-ago figure, leading to a 113-bps contraction in the operating margin to 8.7%.

2020 Guidance

The company provided its 2020 guidance.

For the year, it expects revenues of 14-18%, including an adverse foreign currency impact of 1%. The Zacks Consensus Estimate for the metric is pegged at $865.2 million.

Total Omnipod revenues are expected to be 17-21%, including an adverse foreign currency impact of 1%. U.S. Omnipod revenues are likely to be 18-22%, whereas International Omnipod revenue growth is projected to be 16-20% (including an adverse foreign currency impact of 1%). However, revenues in the Drug Delivery segment are expected to decline 15-20%.

For the first quarter of 2020, Insulet projects revenues of 17-20%, including an adverse foreign currency impact of 1%. The Zacks Consensus Estimate for the metric is pegged at $193.9 million.

Total Omnipod revenues are expected to be 23-26%, including an adverse foreign currency impact of 1%. U.S. Omnipod revenues are likely to be 27-29%, whereas International Omnipod revenue growth is projected to be 17-20% (including an adverse foreign currency impact of 3%). However, revenues in the Drug Delivery segment are expected to decline 28-34%.

Our Take

Insulet exited the year on a mixed note, with fourth-quarter EPS lagging estimates and revenues surpassing the consensus mark. The year-over-year improvement in revenues on the solid uptake of the Omnipod system, both in the United States and across international markets, looks encouraging.

The upbeat outlook for 2020 for the Omnipod business along with continued investments in the company’s pipeline (which includes the clinical trial and subsequent launch of Omnipod Horizon) buoys optimism. It is planning on the expansion of Omnipod DASH across Europe and Canada, which further uplifts market sentiment.

However, we are disappointed with the contraction of both gross and operating margins along with a sharp decline of the fourth-quarter EPS. Also, Insulet is exposed to risks associated with a weaker global economy and lower reimbursement rates.

Zacks Rank & Other Key Picks

Insulet currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks, which reported solid results this earnings season, are Stryker Corporation SYK, STERIS plc STE and ResMed Inc. RMD.

Stryker delivered fourth-quarter 2019 adjusted EPS of $2.49, outpacing the Zacks Consensus Estimate by 1.2%. Its fourth-quarter revenues of $4.13 billion surpassed the consensus estimate by 0.7%. The company currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

STERIS reported third-quarter fiscal 2020 adjusted EPS of $1.45, outpacing the Zacks Consensus Estimate by 1.4%. Net revenues of $774.3 million outpaced the consensus estimate by 3.3%. The company carries a Zacks Rank #2 at present.

ResMed currently carries a Zacks Rank #2. It reported second-quarter fiscal 2020 adjusted EPS of $1.21, surpassing the Zacks Consensus Estimate by 19.8%. Its revenues of $736.2 million outpaced the consensus mark by 1.5%.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

STERIS plc (STE) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance