Insurers can now talk to cars in policy launch for Tesla drivers

Insurers can now communicate directly with cars with the launch of a new policy covering Teslas, and which is targeted at low mileage drivers.

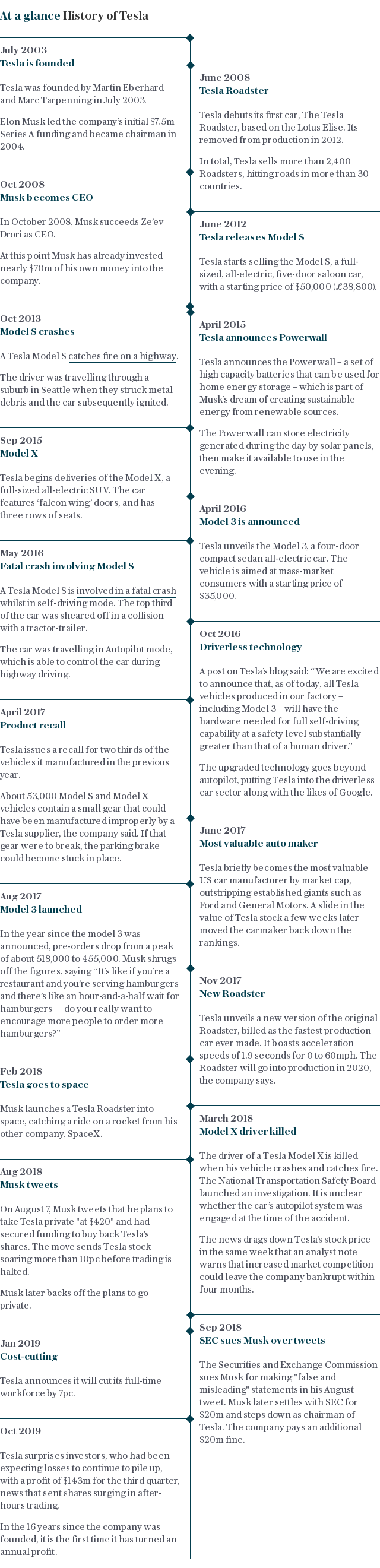

Tesla cars are almost all electric, connect to the internet and can do a limited amount of driving with no need for a human, such as parking themselves. The high-profile vehicle company is led by eccentric billionaire Elon Musk.

But despite their space-age vehicles, Tesla drivers have had to rely on insurance that was much more old fashioned, and no insurer has yet managed to sync up to the cars’ computers.

Now, owners of the cars can connect their vehicles automatically to insurer La Parisienne Assurances, through policies sold by By Miles, a broker.

The policies record a car’s mileage, then calculate a monthly premium based on how far the vehicle has been driven. Motorists can keep track of their insurance through a smartphone app, with no need for any telematics black boxes to be installed in the car.

Traditional insurers have given short thrift to Tesla drivers, who pay above-average premiums and have limited choice.

Only 12 car insurance firms out of 617 offer Tesla insurance, and three of the ones that do are part of Admiral, according to Comparethemarket.com, a price comparison website.

A 32-year-old driver of a Tesla model 3 doing 4,000 miles a year would pay around £679 with By Miles cover, compared to the best rival quote of £1,246 from insurer Churchill.

The By Miles policy will also pay out if Tesla charging cables or batteries are damaged or stolen, which most conventional car insurance would exclude.

The average British car covers 7,800 miles a year, and By Miles said it is targeting “lower mileage” Tesla drivers with the new policy.

If a Tesla owner clocks up more than 7,000 miles on a By Miles policy, then the price will be similar to a traditional car insurance deal.

James Blackham, of By Miles, said insurers would eventually be able to use even more data from cars’ on-board computers to underwrite.

“There is a lot of data available from connected cars,” he said. “A mileometer is just the beginning of what you can use.”

Next steps for insurers could be monitoring the temperature to make sure motorists drive safely in icy conditions, and checking seat sensors so that passengers do not forget to wear seatbelts.

Yahoo Finance

Yahoo Finance