Intel Corp. Is Gearing Up to Build Custom Chips

On chip giant Intel Corp.'s (NASDAQ: INTC) job boards, I found a particularly interesting job listing. It calls for an engineer to work on what Intel claims is a groundbreaking custom high-performance system on a chip.

A system on a chip (SoC) is a chip that integrates most of the key functionality required by the system that it'll go into, as the name implies. This usually means processor cores, dedicated accelerators, the technology that's used to communicate with system memory, and much more.

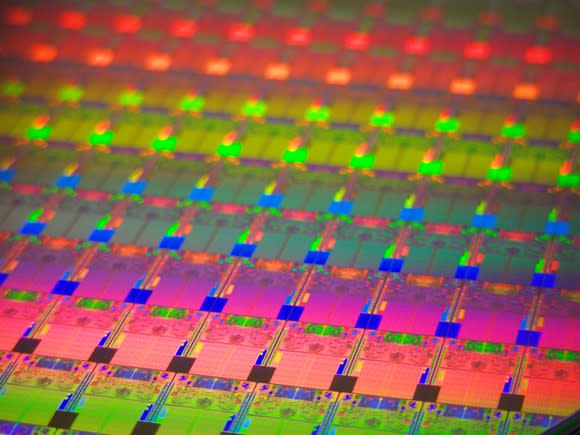

Image source: Intel.

Intel builds many SoCs today targeted at key applications like personal computers, smartphones, data centers, and automotive uses. However, most of Intel's sales consist of chips that are standard products that all of Intel's prospective customers have access to (with relatively minor customization done for the bigger/more important clients).

While most of Intel's revenue will likely continue to come from standard products, I think the odds are good that Intel's business mix will continue to shift toward more-customized products or even full-blown custom processors like the one mentioned in the job listing.

Here's why, and what it would mean for Intel.

The need for customization

One trend you might have noticed is that major systems companies (e.g. smartphone vendors, cloud service providers) are starting to design their own chips. Apple (NASDAQ: AAPL) is probably the highest-profile example of this with its custom iPhone and iPad processors, though companies like Alphabet have started building their own chips as well.

Most of the time, these custom chips aren't built for fun or because a company can -- they're built because the companies building them think that they can get a real benefit in terms of product competitiveness or savings in total cost of ownership.

Obviously, if too many of Intel's major customers decide that they'd be better off staffing up their own large chip teams and cutting Intel out (or, at a minimum, reducing their dependence on Intel products), then that could lead to reduced revenue and profits for the chip giant over the long term.

Intel's aim, therefore, seems to be to try to offer custom chips for large enough customers -- customers that will buy enough product to justify the significant expense of product development (and, more pessimistically, large enough that the loss of that customer would be material to Intel's financials).

The impact to Intel

Ultimately, if Intel can establish a credible business in custom chip design, then the increase in product sales should help accelerate its revenue growth in the areas in which it competes.

Perhaps more important, though, Intel stands to benefit from forming new relationships and strengthening existing ones with major customers. Not only would such collaborations, if successful, lead to near-term revenue growth, but they could also have lasting long-term effects.

For instance, if Company XYZ successfully contracts Intel to build a certain chip, then not only does Intel get the revenue from that chip and potentially many successors, but Company XYZ would also be more inclined to tap Intel for future custom chip needs.

Even deeper than that, if other companies see that Intel is successfully cranking out custom chips, then they may be more inclined to go to Intel with their own needs.

So, if Intel can establish itself as a reliable and capable developer of custom SoCs, it could open up an entirely new stream of revenue over the long term.

More From The Motley Fool

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Ashraf Eassa owns shares of Intel. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), and Apple. The Motley Fool has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool recommends Intel. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance