Intellia (NTLA) to Report Q1 Earnings: What's in the Cards?

We expect investors to focus on Intellia Therapeutics, Inc.’s NTLA progress with the development of its portfolio of CRISPR-based gene-edited therapies when it reports first-quarter 2024 earnings.

Factors to Note

Intellia’s top line currently comprises only collaboration revenues. Revenues in the last quarter were impacted by a $10.3 million recognition adjustment owing to Regeneron Pharmaceuticals REGN extending the technology collaboration to April 2026.

However, NTLA is eligible to receive a $30 million payment as part of the extension by REGN.

Intellia is collaborating with Regeneron for the development of its investigational in vivo genome-editing candidate, NTLA-2001.

In March 2024, the company dosed the first patient in the phase III MAGNITUDE study evaluating NTLA-2001 for the treatment of transthyretin (ATTR) amyloidosis.

The placebo-controlled MAGNITUDE study will evaluate the safety and efficacy of NTLA-2001 in patients with ATTR amyloidosis with cardiomyopathy.

If the data from the MAGNITUDE study is found to be positive, it will enable regulatory filings for the drug across the world.

Investors will be keen to get more updates on the development path ahead for NTLA-2001 on the upcoming earnings call.

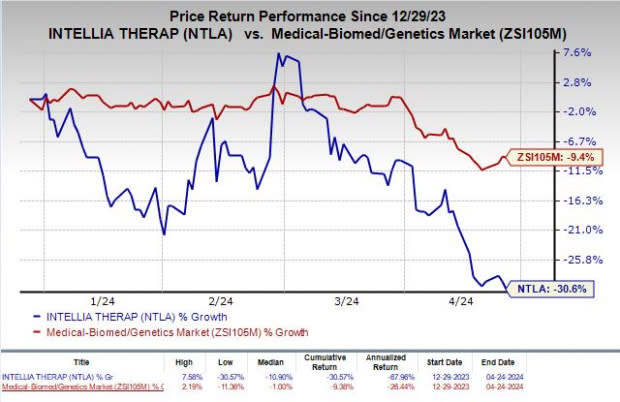

Shares of NTLA have plunged 30.6% year to date compared with the industry’s decline of 9.4%.

Image Source: Zacks Investment Research

NTLA-2001 is also being developed for the treatment of hereditary ATTR amyloidosis with polyneuropathy. Updates for a pivotal phase III study on NTLA-2001 in this additional indication are expected on the upcoming earnings call.

Updates related to Intellia’s other genome-editing therapy, NTLA-2002, which is being evaluated in a phase I/II study for the treatment of hereditary angioedema, are also expected on the upcoming earnings call.

Activities related to the development of pipeline candidates are most likely to have escalated Intellia’s operating expenses in the to-be-reported quarter.

Earnings Surprise History

Intellia has a mixed record of earnings surprise history so far. The company’s earnings beat estimates in three of the trailing four quarters and missed the same on the remaining occasion. NTLA delivered an average surprise of 5.21%. In the last reported quarter, Intellia’s earnings beat estimates by 0.68%.

Intellia Therapeutics, Inc. Price and EPS Surprise

Intellia Therapeutics, Inc. price-eps-surprise | Intellia Therapeutics, Inc. Quote

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Intellia this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Intellia has an Earnings ESP of -3.73% as the Most Accurate Estimate currently stands at a loss of $1.39 per share and the Zacks Consensus Estimate is pegged at a loss of $1.34 per share.

Zacks Rank: Intellia currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are a few stocks worth considering from the healthcare space, as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

Sarepta Therapeutics SRPT has an Earnings ESP of +108.99% and a Zacks Rank #2.

Shares of Sarepta have gained 28.9% in the year-to-date period. Earnings of Sarepta beat estimates in each of the last four quarters, delivering an average earnings surprise of 464.56%. SRPT will report first-quarter earnings results on May 1.

argenx SE ARGX has an Earnings ESP of +15.09% and a Zacks Rank #3.

argenx stock has declined 1.4% year to date. argenx beat earnings estimates in two of the last four quarters, met the same once and missed the mark on the other occasion. On average, ARGX delivered an earnings surprise of 14.18% in the last four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

Intellia Therapeutics, Inc. (NTLA) : Free Stock Analysis Report

argenex SE (ARGX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance