The Intellia Therapeutics (NASDAQ:NTLA) Share Price Is Up 360% And Shareholders Are Delighted

While stock picking isn't easy, for those willing to persist and learn, it is possible to buy shares in great companies, and generate wonderful returns. While not every stock performs well, when investors win, they can win big. In the case of Intellia Therapeutics, Inc. (NASDAQ:NTLA), the share price is up an incredible 360% in the last year alone. It's also good to see the share price up 51% over the last quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. Looking back further, the stock price is 122% higher than it was three years ago.

View our latest analysis for Intellia Therapeutics

Intellia Therapeutics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Intellia Therapeutics saw its revenue grow by 34%. That's a fairly respectable growth rate. But the market is even more excited about it, with the price apparently bound for the moon, up 360% in one of earth's orbits. While we are always careful about jumping on a hot stock too late, there's certainly good reason to keep an eye on Intellia Therapeutics.

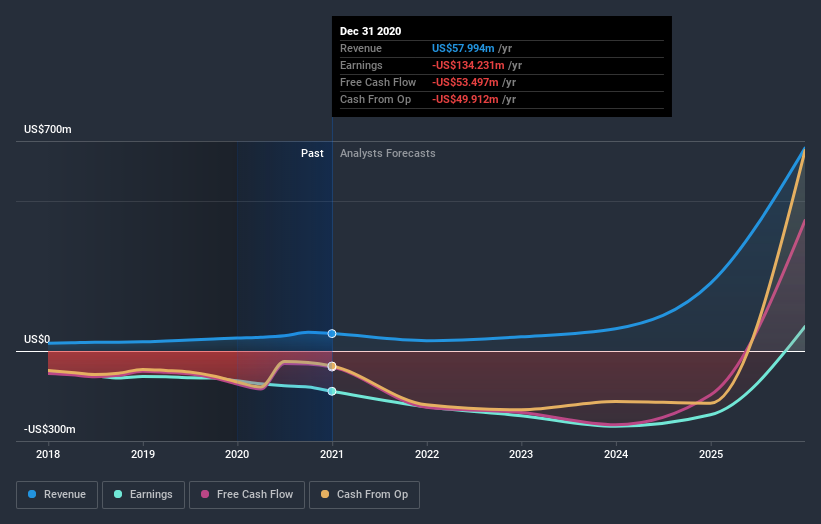

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Intellia Therapeutics stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's nice to see that Intellia Therapeutics shareholders have gained 360% (in total) over the last year. That's better than the annualized TSR of 31% over the last three years. Given the track record of solid returns over varying time frames, it might be worth putting Intellia Therapeutics on your watchlist. It's always interesting to track share price performance over the longer term. But to understand Intellia Therapeutics better, we need to consider many other factors. To that end, you should be aware of the 3 warning signs we've spotted with Intellia Therapeutics .

Of course Intellia Therapeutics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance