How Is Intercept Pharmaceuticals' (NASDAQ:ICPT) CEO Compensated?

This article will reflect on the compensation paid to Mark Pruzanski who has served as CEO of Intercept Pharmaceuticals, Inc. (NASDAQ:ICPT) since 2002. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Intercept Pharmaceuticals.

Check out our latest analysis for Intercept Pharmaceuticals

How Does Total Compensation For Mark Pruzanski Compare With Other Companies In The Industry?

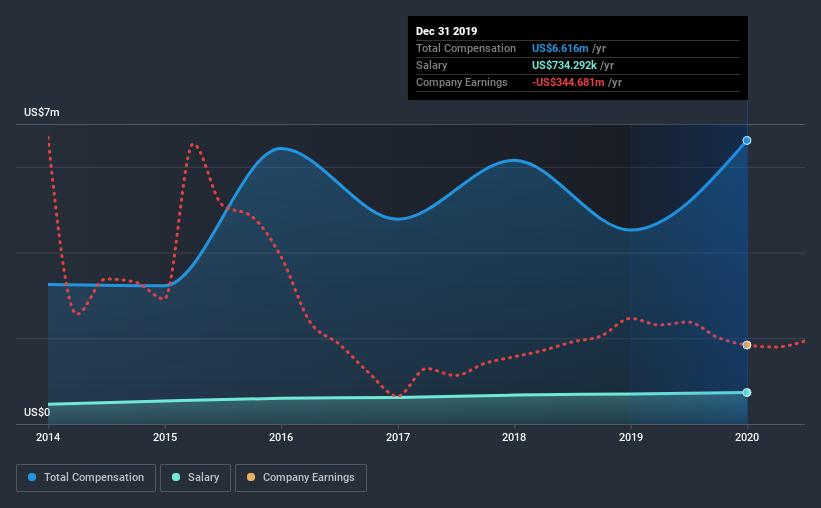

At the time of writing, our data shows that Intercept Pharmaceuticals, Inc. has a market capitalization of US$1.7b, and reported total annual CEO compensation of US$6.6m for the year to December 2019. That's a notable increase of 46% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$734k.

For comparison, other companies in the same industry with market capitalizations ranging between US$1.0b and US$3.2b had a median total CEO compensation of US$4.2m. Accordingly, our analysis reveals that Intercept Pharmaceuticals, Inc. pays Mark Pruzanski north of the industry median. What's more, Mark Pruzanski holds US$30m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2019 | 2018 | Proportion (2019) |

Salary | US$734k | US$702k | 11% |

Other | US$5.9m | US$3.8m | 89% |

Total Compensation | US$6.6m | US$4.5m | 100% |

Talking in terms of the industry, salary represented approximately 23% of total compensation out of all the companies we analyzed, while other remuneration made up 77% of the pie. Intercept Pharmaceuticals sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Intercept Pharmaceuticals, Inc.'s Growth

Intercept Pharmaceuticals, Inc.'s earnings per share (EPS) grew 15% per year over the last three years. It achieved revenue growth of 29% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Intercept Pharmaceuticals, Inc. Been A Good Investment?

Given the total shareholder loss of 49% over three years, many shareholders in Intercept Pharmaceuticals, Inc. are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As we noted earlier, Intercept Pharmaceuticals pays its CEO higher than the norm for similar-sized companies belonging to the same industry. However, the earnings per share growth is certainly impressive, but shareholder returns — over the same period — have been disappointing. Although we'd stop short of calling it inappropriate, we think Mark is earning a very handsome sum.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 2 warning signs for Intercept Pharmaceuticals that investors should be aware of in a dynamic business environment.

Switching gears from Intercept Pharmaceuticals, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance