Intercept's (ICPT) Stock Rises After Layoff Announcement

Shares of Intercept Pharmaceuticals, Inc. ICPT were up 3.5% on Wednesday, after it announced that it will lay off 25% of its workforce, or about 170 employees.

The company made the announcement two months after it received a complete response letter (CRL) from the FDA declining to approve its new drug application for obeticholic acid for the treatment of liver fibrosis due to nonalcoholic steatohepatitis (NASH). In June 2020, the FDA stated that the expected benefit of Ocaliva (obeticholic acid) did not sufficiently outweigh the potential risks to support accelerated approval. Moreover, the agency recommended Intercept to submit additional post-interim analysis efficacy and safety data from the ongoing REGENERATE study in support of potential accelerated approval and continue the long-term outcomes phase of the study.

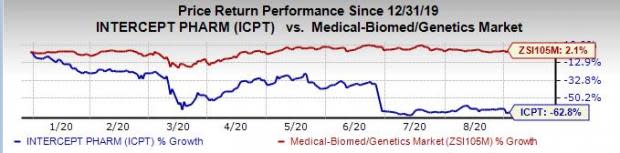

The stock fell more than 30% on that day. Shares of the company have declined 62.8% yearto date against the industry’s growth of 2.1%. The company, however, stated in a filing that it still plans to pursue the approval of obeticholic acid for the treatment of liver fibrosis due to NASH. Per the company, the FDA has progressively increased the complexity of the histologic endpoints, creating a very high bar that only OCA has so far met in a late-stage study. The company is preparing to meet the FDA to discuss the basis for resubmission of the NDA seeking accelerated approval of OCA for the treatment of advanced fibrosis due to NASH.

The layoffs are expected to streamline the company’s operations and reduce operating costs. The plan is expected to be implemented during the third quarter of 2020 and completed by the end of the year.

The job cuts are expected to result in a charge of $18 million, mostly due to severance pay and other termination expenses. The costs also include about $3.5 million in non-cash stock-based compensations. The company expects to incur the majority of these costs during the third quarter of 2020.

We remind investors that obeticholic acid is already marketed by the trade name of Ocaliva for treating primary biliary cholangitis (PBC). It is approved in both the United States and Europe. The drug generated sales of $149.9 million in the first half of 2020, representing growth of 26.4% year over year. The company plans to continue to invest in its growing PBC business.

Zacks Rank & Stocks to Consider

Intercept currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector include Emergent Biosolutions Inc. EBS, Horizon Therapeutics Public Limited Company HZNP and Alimera Sciences Inc. ALIM. While Emergent and Horizon Therapeutics sport a Zacks Rank #1 (Strong Buy), Alimera carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Emergent’s earnings estimates have increased from $3.45 to $6.32 for 2020 and from $4.31 to $7.01 for 2021 over the past 60 days. Shares of the company have increased 106.7% year to date.

Horizon Therapeutics’ earnings estimates have increased from $1.78 to $2.86 for 2020 and from $2.74 to $4.29 for 2021 over the past 60 days. Shares of the company have gained 108.2% year to date.

Alimera’s loss per share estimates have narrowed from $2.33 to $1.31 for 2020 and from 63 cents to 52 cents for 2021 over the past 60 days. Shares of the company have decreased 25.4% year to date.

Intercept Pharmaceuticals, Inc. Price

Intercept Pharmaceuticals, Inc. price | Intercept Pharmaceuticals, Inc. Quote

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity. A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emergent Biosolutions Inc. (EBS) : Free Stock Analysis Report

Horizon Therapeutics Public Limited Company (HZNP) : Free Stock Analysis Report

Alimera Sciences, Inc. (ALIM) : Free Stock Analysis Report

Intercept Pharmaceuticals, Inc. (ICPT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance