Interface Inc (TILE) Q1 2024 Earnings: Surpasses Analyst Revenue Forecasts with Strong ...

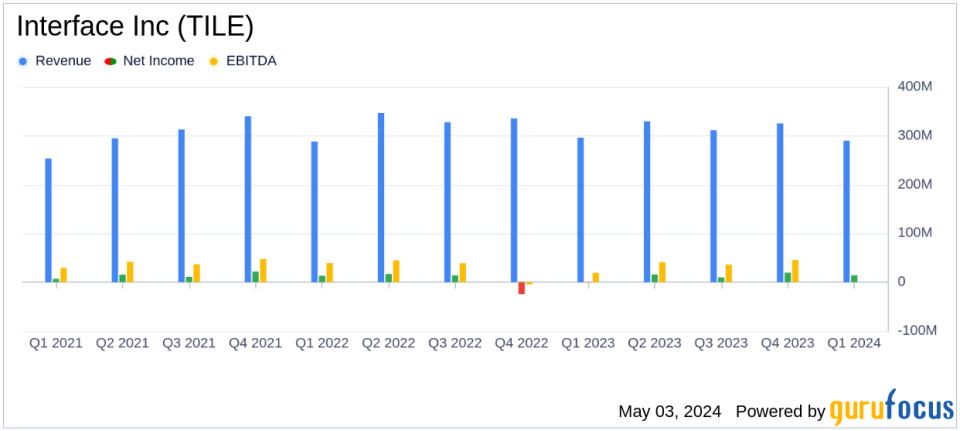

Revenue: Reported at $289.7 million, down 2% year-over-year, above estimates of $285.02 million.

Gross Profit Margin: Increased significantly to 38.1%, up from 32.42% in the previous year, highlighting improved operational efficiency.

Earnings Per Share (EPS): Achieved $0.24, doubling the estimated $0.12, reflecting stronger profitability.

Net Income: $14.2 million, a substantial recovery from a net loss of $0.7 million in the same quarter last year, and well above the estimated $8.01 million.

Adjusted EBITDA: Rose to $38.8 million from $26.3 million year-over-year, indicating enhanced earnings before interest, taxes, depreciation, and amortization.

Operational Highlights: Notable sales growth in the Americas with orders up 5.1% year-over-year, driven by effective pricing and mix management.

Future Guidance: Increased full-year net sales forecast to $1.29 billion to $1.31 billion, anticipating continued growth in gross profit margins.

Interface Inc (NASDAQ:TILE) released its 8-K filing on May 3, 2024, revealing a robust start to the fiscal year with first-quarter results that not only surpassed analyst revenue forecasts but also demonstrated significant profitability improvements. The company, a global leader in commercial flooring and sustainability, reported a net sales of $289.7 million, slightly above the estimated $285.02 million, despite a year-over-year decrease of 2%.

Interface Inc is renowned for its innovative designs and sustainable flooring solutions, catering to diverse markets including corporate offices, healthcare, education, and hospitality across the Americas, Europe, and Asia-Pacific. This quarter's performance underscores the effectiveness of the company's strategic initiatives, particularly its "One Interface" strategy aimed at simplifying operations and enhancing global integration.

Financial Highlights and Strategic Wins

The first quarter saw Interface achieve a gross profit margin of 38.1%, a significant increase from the previous year, driven by favorable product mix, higher selling prices, and input cost deflation. This margin expansion contributed to an operating income of $24.4 million, more than double the $9.5 million recorded in the same period last year. Adjusted earnings per share (EPS) stood at $0.24, starkly higher than the $0.07 in Q1 2023 and doubling the estimated EPS of $0.12.

CEO Laurel Hurd highlighted the success of the "One Interface" approach and the launch of the new brand attitude "Made for More", which reflects the companys commitment to high-quality, purpose-driven products. CFO Bruce Hausmann noted the effective execution in commercial activities that led to a 5.1% growth in orders, setting a positive tone for the upcoming quarters.

Operational and Segment Analysis

Interface's operational success was mirrored in its segment performance. The Americas (AMS) segment saw a slight increase in sales, while orders surged by 6.8%. Conversely, the EMEA and Asia segments experienced a sales dip, although orders in Asia notably jumped by 14.9%. This mixed geographical performance illustrates the dynamic challenges Interface faces across different markets.

The company's balance sheet remains strong with $89.8 million in cash and a reduced total debt of $391.8 million, down from $417.2 million at the end of 2023. These figures reflect Interface's prudent financial management and its ability to maintain stability amidst global economic fluctuations.

Looking Ahead

With an optimistic outlook for 2024, Interface has raised its full-year net sales guidance to between $1.29 billion and $1.31 billion, anticipating continued gross margin improvements. The firm also expects capital expenditures of around $42 million as it continues to invest in its operational capabilities and sustainability initiatives.

Despite the promising start, Interface remains cautious about the volatile macroeconomic environment, emphasizing the need for flexibility and innovation in its operations. The company's forward-looking strategies, focus on high-margin segments, and robust financial health position it well to navigate potential challenges and capitalize on market opportunities.

For detailed financial figures and future projections, investors and stakeholders are encouraged to view the full earnings report and tune into the upcoming webcast detailed on Interface's investor relations website.

Explore the complete 8-K earnings release (here) from Interface Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance