'Never seen anything like this': Bookings for overseas flights from US plummet

Bookings for international flights departing the U.S. suffered another steep decline over the past week, as would-be passengers concerned about COVID-19 shied away from travel commitments.

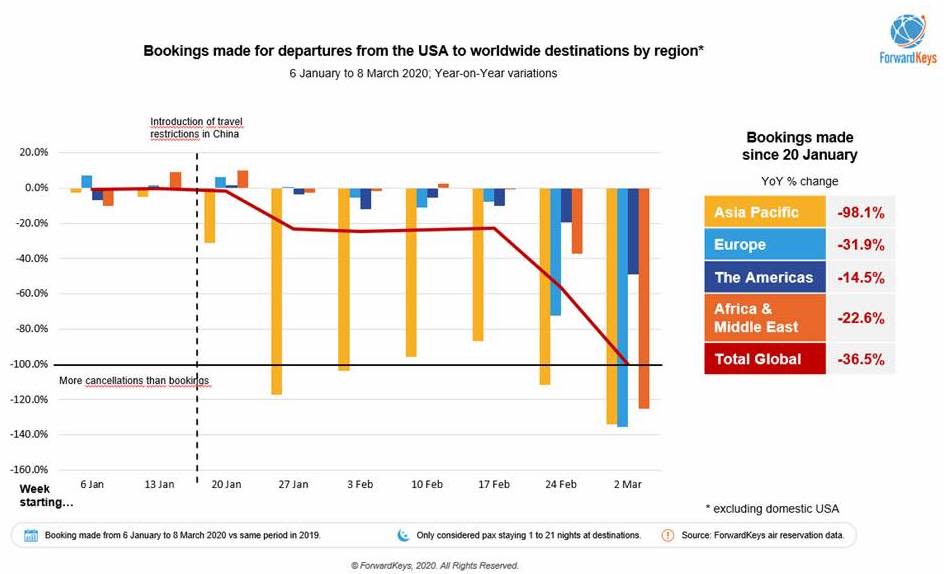

ForwardKeys, a data firm that tracks more than 17 million business and leisure bookings each day, exclusively told Yahoo Finance’s “On The Move” on Wednesday that U.S. international bookings dropped 36.5% year-over-year for the period of January 20 to March 8.

Most strikingly, in the week of March 2, cancellations for international flights departing from the U.S. outpaced bookings, according to Olivier Ponti, Vice President for ForwardKeys Insights.

“Let's be clear about this. We've never seen anything like this before. This is unprecedented and it's going extremely, extremely fast,” Ponti said. “The situation is changing at a very fast pace.”

The decline follows a less significant decrease of 19% for U.S. international departures booked between January 20 and February 23. Both sets of data track trends starting the day before the Centers for Disease Control confirmed the first U.S. case of coronavirus on January 21.

ForwardKeys says its data reflects 30% to 40% of all airline industry bookings. Excluded are flights booked directly through airlines. Its figures are based on business and leisure bookings processed through Global Distribution Systems (GDS) that also support major travel sites such as Booking.com (BKNG) and Expedia Group (EXPE) companies Orbitz, Travelocity, and Hotwire, as well as travel agents, online agents, and travel agencies.

Markets outside the U.S. are suffering a similar fate, with high-risk regions — including the epicenter of the outbreak, China, along with South Korea, Italy and Iran — facing the toughest declines. Given the bulk of overseas bookings that represent U.S.-bound flights, minimal bookings elsewhere are certain to result in a domino effect that negatively impacts revenue for both airlines and the broader travel and tourism industry.

“When we look at year-on-year variation by week, we see the situation keeps deteriorating,” Ponti said. “Three weeks ago outbound bookings for the U.S. were about 24% down. Two weeks ago they were 50% down. And last week we've reached a moment when there were actually more cancellations than bookings.”

Ponti cautions that the delayed impact means consequences of the current situation are unlikely to be fully seen until months after the coronavirus is under control, and that a recovery is challenging to predict. Unlike a terror attack or natural disaster, he said, the current problems are not localized. Wishful travelers concerned about falling ill cannot simply choose a flight and destination where they can be assured the virus does not exist.

“There is no engine anymore. The number one outgoing market worldwide, China, has disappeared pretty much from one day to the next. And the number two outgoing of the market (the U.S.) is also starting to show signs of slowdown. It's already in a crisis. We’ve got so few bookings coming from the U.S. that clearly this will impact on the travel sector worldwide,” Ponti said.

U.S. Travel Association economists said in March 2019 international visitors who flew to the U.S. from Europe, excluding the United Kingdom, represented approximately 29% of total overseas arrivals to the U.S. “These visitors spent approximately $3.4 billion in the U.S,” the Association said.

Additional U.S. travel restrictions on certain inbound travelers from Europe, effective Friday, are expected to exacerbate pressure on international routes. In a public address Wednesday evening, President Donald Trump banned individuals, other than U.S. citizens, nationals, lawful residents, and guests of the federal government, from entering the U.S. who within 14 days of attempted entry were physically present in Europe's Schengen zone.

Editor’s note: This story was updated to reflect the U.S. ban on travelers from Europe’s Schengen area, announced Wednesday by President Trump.

Alexis Keenan is a reporter for Yahoo Finance. Follow her on Twitter @alexiskweed.

Read more:

Coronavirus has spurred an ‘unprecedented’ wave of US flight cancellatons, analyst says

Airline CEOs warn coronavirus is cutting into reservations and are prepared for it to get worse

Coronavirus and travel: What you need to know

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and Reddit.

Yahoo Finance

Yahoo Finance