Challenger banks trounce high street rivals on international payments

How much does it cost to send £100 ($127) from a UK bank account to the US? It depends who you bank with.

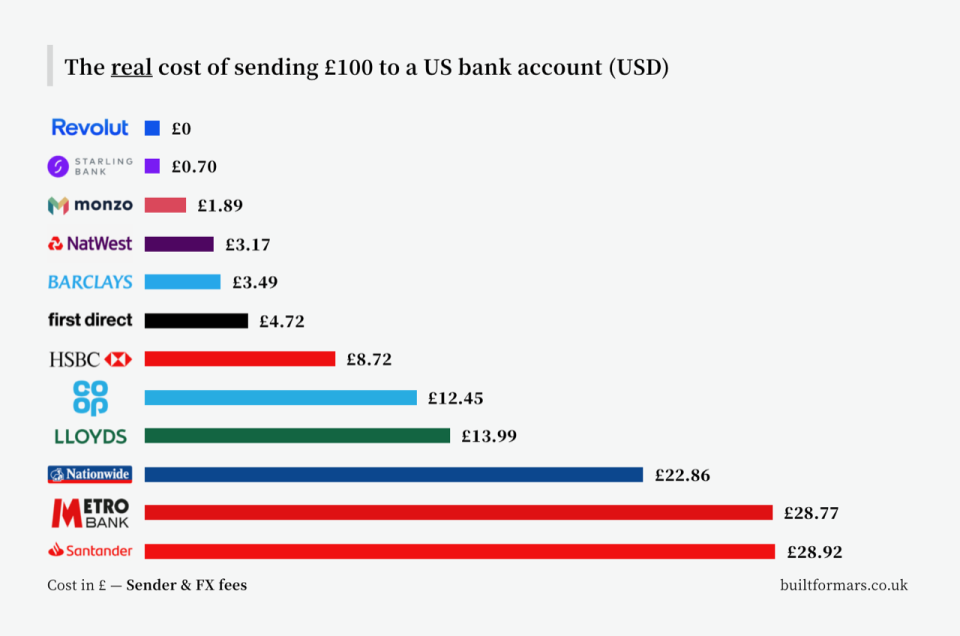

A new survey of major high street banks and challenger rivals found a huge disparity between the cost of sending cash abroad. Costs range from completely free to almost £30 — a third of the cash being sent.

Built for Mars, a user experience design consultancy, on Thursday published an article examining the cost of sending £100 to the US online with 12 banks and fintechs. Built for Mars looked at declared fees, the exchange rates offered, and foreign exchange costs to calculate the true total cost of sending the money abroad.

“I think most people assume they're better, but are they?” Peter Ramsey, founder of Built for Mars, told Yahoo Finance UK. “This was a way for me to benchmark all the banks against each other.”

The cheapest was challenger Revolut, which charged nothing to send money overseas. At the other end of the spectrum, Santander (SAN) and Metro Bank (MTRO.L) both charged more than £28 to send £100.

All the digital challenger banks Ramsey looked at were cheaper than more traditional rivals. The cheapest high street bank was NatWest, which charged £3.17 on the online transfer of £100 overseas.

“I think what surprised me the most was how much faster the challenger banks are at just about everything,” Ramsey said. “Opening an account, making a payment, notifications — they're consistently quick. I knew they would be, but I'd underestimated how laborious some of the incumbent banks are.”

A spokesperson for Santander said: “There are a range of ways to transfer money abroad and different costs will apply depending on which method is used.

“Santander offers all customers a completely fee-free way of transferring money into a range of currencies, including US Dollars, through our OnePayFX offering. We would encourage any customer looking to transfer money abroad to talk to us about the best, most cost efficient way of doing this.”

OnePayFX is an app backed by Santander that uses blockchain technology to transfer money into euros, Polish Zlotys and US dollars for free. The services is not built into Santander’s desktop banking service.

A spokesperson for Metro Bank said: “We are confident that our bank accounts continue to offer great value and service to our customers. We regularly review our products to ensure that we remain competitive.”

Yahoo Finance

Yahoo Finance