Service International (NYSE:SCI): Strongest Q1 Results from the Specialized Consumer Services Group

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the specialized consumer services stocks, including Service International (NYSE:SCI) and its peers.

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

The 11 specialized consumer services stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 0.6%. while next quarter's revenue guidance was in line with consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and while some of the specialized consumer services stocks have fared somewhat better than others, they collectively declined, with share prices falling 2.8% on average since the previous earnings results.

Best Q1: Service International (NYSE:SCI)

Founded in 1962, Service International (NYSE: SCI) is a leading provider of death care products and services in North America.

Service International reported revenues of $1.05 billion, up 1.6% year on year, topping analysts' expectations by 2.7%. It was a good quarter for the company, with a decent beat of analysts' earnings estimates.

The stock is down 1.8% since the results and currently trades at $70.08.

Is now the time to buy Service International? Access our full analysis of the earnings results here, it's free.

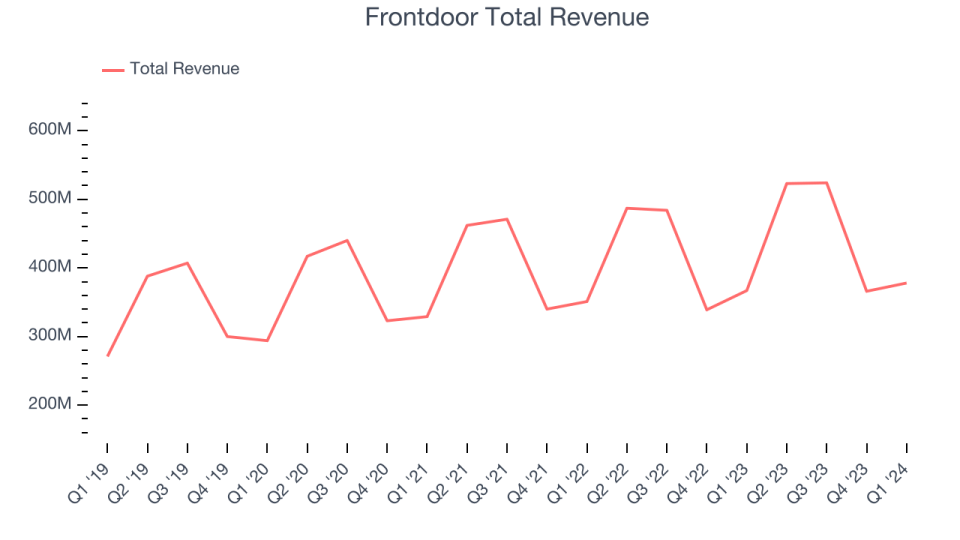

Frontdoor (NASDAQ:FTDR)

Established in 2018 as a spin-off from ServiceMaster Global Holdings, Frontdoor (NASDAQ:FTDR) is a provider of home warranty and service plans.

Frontdoor reported revenues of $378 million, up 3% year on year, in line with analysts' expectations. It was a decent quarter for the company, with an impressive beat of analysts' earnings estimates but a miss of analysts' home service plans estimates.

Frontdoor had the weakest full-year guidance update among its peers. The stock is up 11% since the results and currently trades at $34.15.

Is now the time to buy Frontdoor? Access our full analysis of the earnings results here, it's free.

Weakest Q1: 1-800-FLOWERS (NASDAQ:FLWS)

Founded in 1976, 1-800-FLOWERS (NASDAQ:FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

1-800-FLOWERS reported revenues of $379.4 million, down 9.1% year on year, falling short of analysts' expectations by 1.2%. It was a weak quarter for the company. Its revenue, operating margin, and EPS fell short of Wall Street's estimates.

The stock is up 5.1% since the results and currently trades at $9.5.

Read our full analysis of 1-800-FLOWERS's results here.

ADT (NYSE:ADT)

Founded in 1874 and headquartered in Boca Raton, Florida, ADT (NYSE:ADT) is a provider of security, automation, and smart home solutions, offering comprehensive services for home and business protection.

ADT reported revenues of $1.21 billion, down 5.3% year on year, falling short of analysts' expectations by 0.3%. It was a decent quarter for the company, with an impressive beat of analysts' earnings estimates but a miss of analysts' customers estimates.

The stock is up 15.7% since the results and currently trades at $7.36.

Read our full, actionable report on ADT here, it's free.

LKQ (NASDAQ:LKQ)

A global distributor of vehicle parts and accessories, LKQ (NASDAQ:LKQ) offers its customers a comprehensive selection of high-quality, affordably priced automobile products.

LKQ reported revenues of $3.70 billion, up 10.6% year on year, falling short of analysts' expectations by 1.6%. It was a weak quarter for the company, with a miss of analysts' earnings estimates and a miss of analysts' organic revenue estimates.

LKQ pulled off the fastest revenue growth among its peers. The stock is down 14.2% since the results and currently trades at $41.96.

Read our full, actionable report on LKQ here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance