"Interpret, don't Predict" When it Comes to Home Builders.

Puzzling Action in the Home Builders

In 2021 the average mortgage rate was 2.96%, and by the end of 2022, the average increased to over 5% - a staggering increase. Compound this with the fact that the economy weakening, the American consumer had record credit card debt, and inflation rose to 40-year highs. For these reasons, the performance in home builders over the past few months is puzzling to many investors. Over the past four months, the SPDR S&P Home Builders ETF XHB is up ~19% versus just 4.5% in the S&P 500 Index.

Image Source: Zacks Investment Research

Home Builders are up, but why?

On Wall Street, the closest thing investors have to a scoreboard is the price action in an equity. One can theorize why home builders shouldn’t be going up or why they may not continue to, but as pickup basketball players like to remind each other, “the scoreboard doesn’t lie.

No one can argue that a dramatic increase in borrowing rates reduces the demand for new homes. However, several factors can still make for a robust home building environment, including:

1. Limited housing supply: Though demand has slowed, supply remains very low. As long as demand is higher than supply, home builders should benefit.

2. Strong economic growth: Much of Wall Street is in the camp that the U.S. economy will suffer a “hard landing”. However, home builders may be discounting the future and anticipating recovery over the next year. A growing economy and low unemployment may once again boost demand.

3. Innovative building techniques: Home builders such as Toll Brothers TOL are benefitting from their unique offerings. Toll Brothers offers clients the option of a “build-to-order model”. In other words, the model enables buyers to pick a specific location and select particular design and structural options. While higher-priced homebuilders offer these services, Toll Brothers provides these options to the mass market. The result has been a home run for Toll. Toll Brothers has a backlog of ~8,000 equating to nearly $9 billion in value.

The Bull Argument

We have described why housing stocks have increased in recent months, but can they continue?

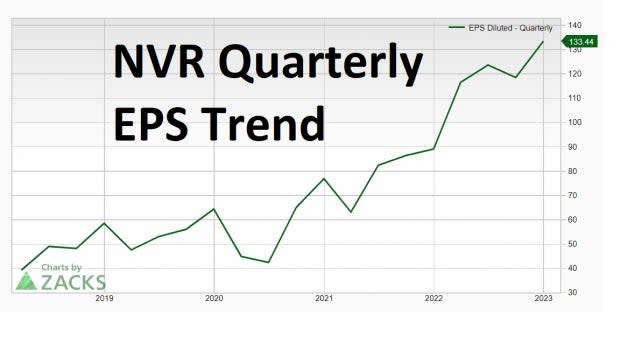

Quality home builders such as NVR Inc NVR are still executing. Last quarter, NVR’s EPS grew at a healthy 50% on revenue growth of 24%.

Image Source: Zacks Investment Research

NVR also boasts a Zacks Rank #1 (Strong Buy). In August, management announced a share buyback of $500 million worth of common stock – showing confidence in the business moving forward.

Valuations are still reasonable in many home builders, such as Meritage Homes MTH. MTH’s P/E ratio of 4.15x puts its valuation lower than the 2020 pandemic low.

Image Source: Zacks Investment Research

Generally, the first pullback to the 50-day moving average after a breakout and strong trend presents investors with an area of favorable risk to reward. Several home builders are doing just this, including Lennar Corp LEN, MI Homes MHO, and several more.

Image Source: Zacks Investment Research

Interpret Don’t Predict

If there is one thing home builders have taught us this year, it’s that investors should interpret rather than predict. Currently, the fundamental picture remains strong, price continues to trend, and several home builders like Toll Brothers have backlogs – a bullish sign. Homebuilders such as Green Brick Partners GRBK and Hovnanian HOV are set to report this week. These reports, coupled with how the stocks act at their 50-day moving average, should provide investors with more evidence of this rally’s strength. Investors should take an “if, then” approach rather than a one-size-fits-all approach. For example, “if housing stocks hold the 50-day moving average, I will hold. If they break below it decisively, I will cut my losses”. Presently, the trend remains up for this strong industry.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

Hovnanian Enterprises Inc (HOV) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

SPDR S&P Homebuilders ETF (XHB): ETF Research Reports

M/I Homes, Inc. (MHO) : Free Stock Analysis Report

Green Brick Partners, Inc. (GRBK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance