Interpublic (IPG) Misses Q1 Earnings & Revenue Estimates

The Interpublic Group of Companies, Inc. IPG reported weak first-quarter 2018 results with revenues and earnings lagging the Zacks Consensus Estimate.

Interpublic reported first-quarter 2018 GAAP loss of $14.1 million or loss of 4 cents per share against earnings of $24.7 million or 6 cents in the year-earlier quarter. Excluding non-recurring items, earnings of 3 cents missed the Zacks Consensus Estimate by 1 cent.

Interpublic’s first-quarter 2018 net revenues of $1,774 million also missed the Zacks Consensus Estimate of $1,793.1 million. However, the figure increased 5.9% year over year. The year-over-year growth was driven by favorable foreign currency movement of 3% and organic growth of 3.6%. There was a negative impact of 0.7% from net divestures.

First-quarter 2018 total revenues were $2,169.1 million, up 5.1% from the year-ago quarter.

Interpublic Group of Companies, Inc. (The) Revenue (TTM)

Interpublic Group of Companies, Inc. (The) Revenue (TTM) | Interpublic Group of Companies, Inc. (The) Quote

Interpublic witnessed organic growth of 4.3% in the United States and 2.6% in international markets.

Operating Results

Operating income in first-quarter 2018 increased 11.8% year over year to $38.8 million. Operating margin on net revenue was 2.2% compared with 2.1% in the year-ago quarter. Operating margin on total revenue was 1.8% compared with 1.7% in the year-ago quarter. Operating expenses increased 5% from the year-ago quarter to $2,130.3 million.

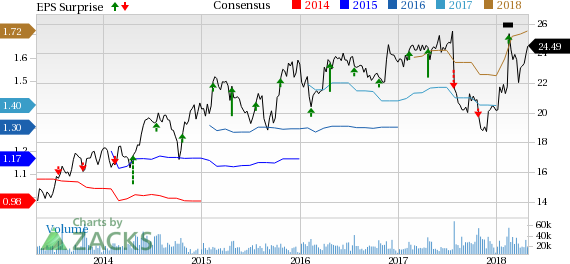

Interpublic Group of Companies, Inc. (The) Price, Consensus and EPS Surprise

Interpublic Group of Companies, Inc. (The) Price, Consensus and EPS Surprise | Interpublic Group of Companies, Inc. (The) Quote

Balance Sheet

Interpublic exited first-quarter 2018 with cash, cash equivalents and marketable securities of $597.4 million compared with $778.1 million in the year-ago quarter. As of Mar 31, 2018, total debt was $2.09 billion compared with $1.37 billion at the end of 2017.

Share Repurchase Program and Dividend

During the first quarter of 2018, the company repurchased 2.4 million shares at an aggregate cost of $54.9 million and an average price of $22.59 per share, including fees.

During the reported quarter, the company also declared and paid a cash dividend of 21 cents per share, aggregating $80.8 million.

2018 Outlook

Interpublic reaffirmed its target for 2018. The company expects organic revenue growth of 2% to 3% and operating margin expansion of 60 to 70 basis points from its restated 2017 results.

Zacks Rank & Upcoming Releases

Interpublic Group currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Investors interested in the broader Business Services sector are keenly awaiting first-quarter earnings reports from key players like Fiserv, Inc. FISV, Verisk Analytics, Inc. VRSK and Automatic Data Processing ADP. While Fiserv and Verisk Analytics are slated to report quarterly numbers on May 1, Automatic Data Processing will release its results on May 2.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Fiserv, Inc. (FISV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance