Is Intertek Group plc (LON:ITRK) Spending Too Much Money?

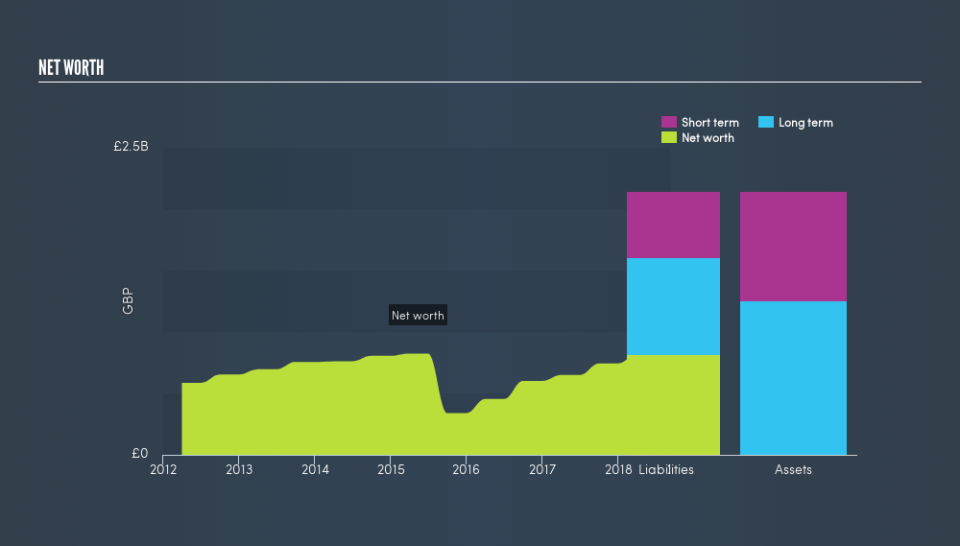

If you are currently a shareholder in Intertek Group plc (LON:ITRK), or considering investing in the stock, you need to examine how the business generates cash, and how it is reinvested. What is left after investment, determines the value of the stock since this cash flow technically belongs to investors of the company. I will take you through ITRK’s cash flow health and the risk-return concept based on the stock’s cash flow yield, using the most recent financial data. This will help you think about the company from a cash perspective, which is a crucial factor to investing.

Check out our latest analysis for Intertek Group

What is free cash flow?

Intertek Group’s free cash flow (FCF) is the level of cash flow the business generates from its operational activities, after it reinvests in the company as capital expenditure. This type of expense is needed for Intertek Group to continue to grow, or at least, maintain its current operations.

I will be analysing Intertek Group’s FCF by looking at its FCF yield and its operating cash flow growth. The yield will tell us whether the stock is generating enough cash to compensate for the risk investors take on by holding a single stock, which I will compare to the market index. The growth will proxy for sustainability levels of this cash generation.

Free Cash Flow = Operating Cash Flows – Net Capital Expenditure

Free Cash Flow Yield = Free Cash Flow / Enterprise Value

where Enterprise Value = Market Capitalisation + Net Debt

Along with a positive operating cash flow, Intertek Group also generates a positive free cash flow. However, the yield of 3.37% is not sufficient to compensate for the level of risk investors are taking on. This is because Intertek Group’s yield is well-below the market yield, in addition to serving higher risk compared to the well-diversified market index.

What’s the cash flow outlook for Intertek Group?

Can ITRK improve its operating cash production in the future? Let’s take a quick look at the cash flow trend the company is expected to deliver over time. In the next few years, the company is expected to grow its cash from operations at a double-digit rate of 19%, ramping up from its current levels of UK£429m to UK£509m in two years’ time. Furthermore, breaking down growth into a year on year basis, ITRK is able to increase its growth rate each year, from 5.3% next year, to 13% in the following year. The overall picture seems encouraging, should capital expenditure levels maintain at an appropriate level.

Next Steps:

Although its positive operating cash flow, and high future growth, is appealing, the low free cash flow yield is unattractive. This is because you would be better compensated in terms of cash yield, by investing in the market index, as well as take on lower diversification risk. However, cash is only one aspect of investing. Keep in mind that cash is only one aspect of investment analysis and there are other important fundamentals to assess. I recommend you continue to research Intertek Group to get a more holistic view of the company by looking at:

Valuation: What is ITRK worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether ITRK is currently mispriced by the market.

Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Intertek Group’s board and the CEO’s back ground.

Other High-Performing Stocks: If you believe you should cushion your portfolio with something less risky, scroll through our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance