Introducing Aerie Pharmaceuticals, The Stock That Zoomed 271% In The Last Three Years

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But when you pick a company that is really flourishing, you can make more than 100%. For instance the Aerie Pharmaceuticals, Inc. (NASDAQ:AERI) share price is 271% higher than it was three years ago. Most would be happy with that. It’s also good to see the share price up 17% over the last quarter. This could be related to the recent financial results, released recently – you can catch up on the most recent data by reading our company report.

Check out our latest analysis for Aerie Pharmaceuticals

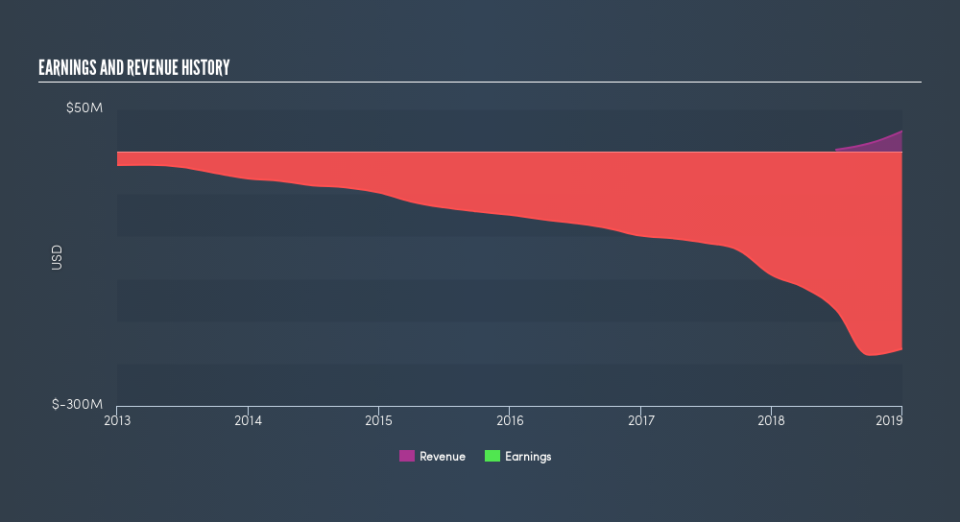

Aerie Pharmaceuticals isn’t currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That’s because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Depicted in the graphic below, you’ll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on Aerie Pharmaceuticals

A Different Perspective

While the broader market gained around 2.6% in the last year, Aerie Pharmaceuticals shareholders lost 19%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 18% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares – and the price they paid.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance