Introducing CosmoSteel Holdings (SGX:B9S), The Stock That Tanked 79%

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We really hate to see fellow investors lose their hard-earned money. Spare a thought for those who held CosmoSteel Holdings Limited (SGX:B9S) for five whole years - as the share price tanked 79%. Shareholders have had an even rougher run lately, with the share price down 12% in the last 90 days.

See our latest analysis for CosmoSteel Holdings

Because CosmoSteel Holdings is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade CosmoSteel Holdings reduced its trailing twelve month revenue by 14% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not altogether surprising to see the share price down 27% per year in the same time period. This kind of price performance makes us very wary, especially when combined with falling revenue. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

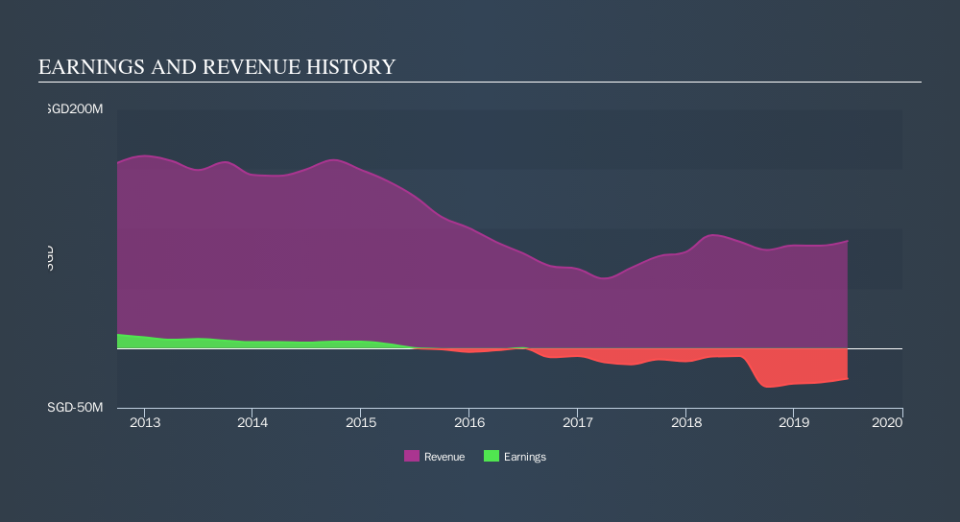

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of CosmoSteel Holdings's earnings, revenue and cash flow.

A Dividend Lost

It's important to keep in mind that we've been talking about the share price returns, which don't include dividends, while the total shareholder return does. In some ways, TSR is a better measure of how well an investment has performed. CosmoSteel Holdings's TSR over the last 5 years is -77%; better than its share price return. Even though the company isn't paying dividends at the moment, it has done in the past.

A Different Perspective

CosmoSteel Holdings provided a TSR of 1.3% over the last twelve months. But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 25% endured over half a decade. So this might be a sign the business has turned its fortunes around. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

CosmoSteel Holdings is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance