Introducing DMG Blockchain Solutions (CVE:DMGI), The Stock That Soared 763% In The Last Year

For many, the main point of investing in the stock market is to achieve spectacular returns. When you find (and hold) a big winner, you can markedly improve your finances. For example, DMG Blockchain Solutions Inc. (CVE:DMGI) has generated a beautiful 763% return in just a single year. Also pleasing for shareholders was the 626% gain in the last three months. DMG Blockchain Solutions hasn't been listed for long, so it's still not clear if it is a long term winner.

We love happy stories like this one. The company should be really proud of that performance!

See our latest analysis for DMG Blockchain Solutions

DMG Blockchain Solutions wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

DMG Blockchain Solutions actually shrunk its revenue over the last year, with a reduction of 37%. So it's very confusing to see that the share price gained a whopping 763%. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. While this gain looks like speculative buying to us, sometimes speculation pays off.

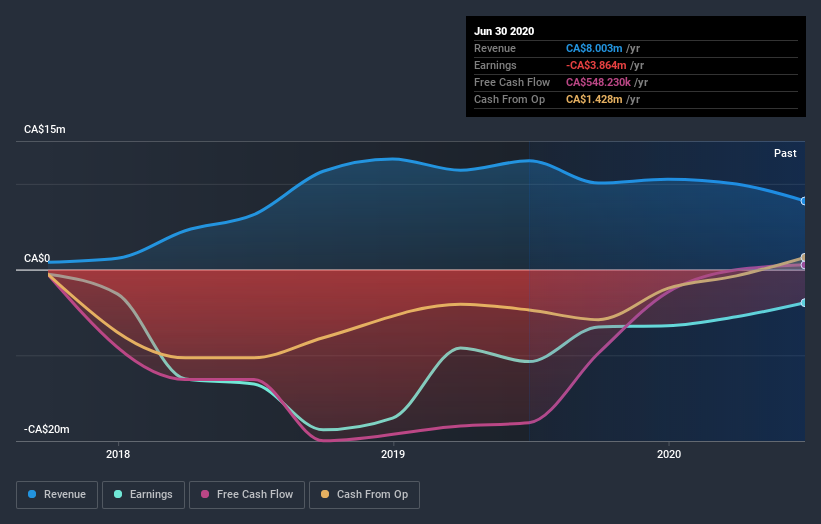

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

DMG Blockchain Solutions boasts a total shareholder return of 763% for the last year. And the share price momentum remains respectable, with a gain of 626% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for DMG Blockchain Solutions (of which 1 is a bit unpleasant!) you should know about.

Of course DMG Blockchain Solutions may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance