Introducing Ero Copper (TSE:ERO), A Stock That Climbed 61% In The Last Year

Ero Copper Corp. (TSE:ERO) shareholders might be concerned after seeing the share price drop 19% in the last month. But that doesn't change the reality that over twelve months the stock has done really well. After all, the share price is up a market-beating 61% in that time.

See our latest analysis for Ero Copper

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Ero Copper went from making a loss to reporting a profit, in the last year.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

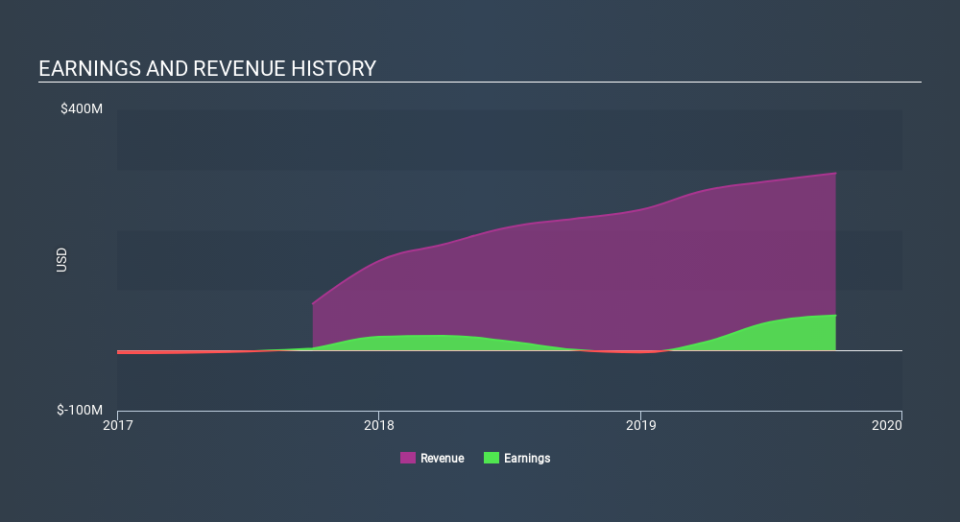

We think that the revenue growth of 35% could have some investors interested. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Ero Copper is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Ero Copper will earn in the future (free analyst consensus estimates)

A Different Perspective

Ero Copper shareholders should be happy with the total gain of 61% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 16% in that time. This suggests the company is continuing to win over new investors. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Ero Copper that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance