Introducing Masco (NYSE:MAS), The Stock That Dropped 23% In The Last Year

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the Masco Corporation (NYSE:MAS) share price slid 23% over twelve months. That falls noticeably short of the market return of around -17%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 13% in three years. In the last ninety days we've seen the share price slide 38%. Of course, this share price action may well have been influenced by the 28% decline in the broader market, throughout the period.

Check out our latest analysis for Masco

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the Masco share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

It's surprising to see the share price fall so much, despite the improved EPS. So it's well worth checking out some other metrics, too.

With a low yield of 1.8% we doubt that the dividend influences the share price much. Revenue was fairly steady year on year, which isn't usually such a bad thing. However, it is certainly possible the market was expecting an uptick in revenue, and that the share price fall reflects that disappointment.

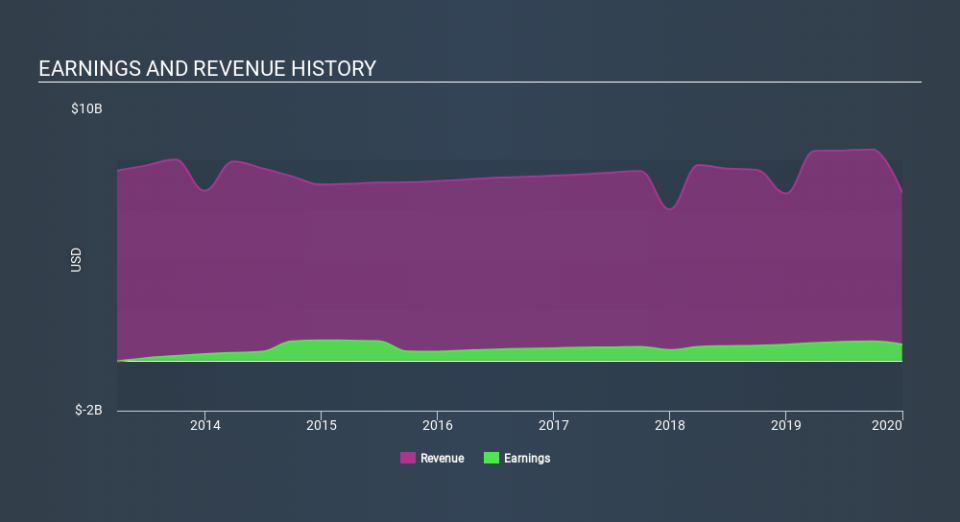

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Masco is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Masco stock, you should check out this free report showing analyst consensus estimates for future profits.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Masco's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Masco shareholders, and that cash payout explains why its total shareholder loss of 22%, over the last year, isn't as bad as the share price return.

A Different Perspective

While the broader market lost about 17% in the twelve months, Masco shareholders did even worse, losing 22% (even including dividends) . Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 6.4%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Masco that you should be aware of before investing here.

But note: Masco may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance