Introducing Mind Gym (LON:MIND), A Stock That Climbed 100% In The Last Year

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But if you pick the right individual stocks, you could make more than that. For example, the Mind Gym plc (LON:MIND) share price is up 100% in the last year, clearly besting the market return of around 14% (not including dividends). That's a solid performance by our standards! The longer term returns have not been as good, with the stock price only 3.5% higher than it was three years ago.

View our latest analysis for Mind Gym

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last twelve months Mind Gym went from profitable to unprofitable. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. It may be that the company has done well on other metrics.

Mind Gym's revenue actually dropped 18% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

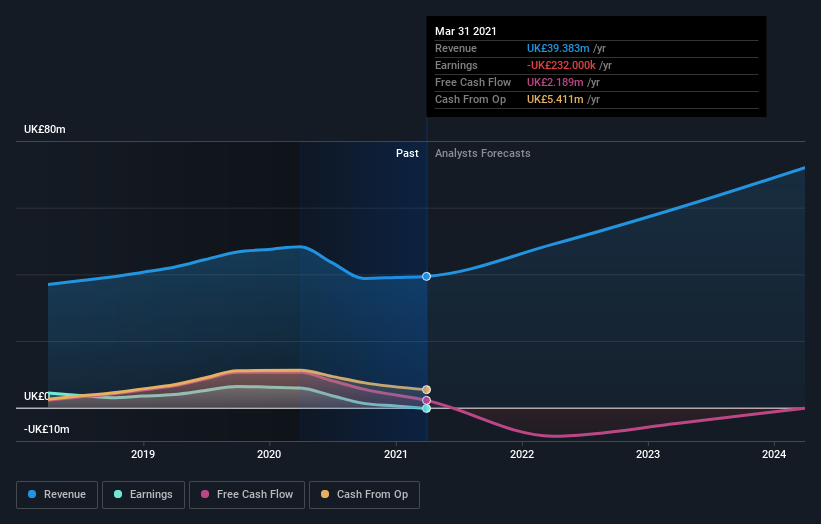

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Mind Gym will earn in the future (free profit forecasts).

A Different Perspective

Pleasingly, Mind Gym's total shareholder return last year was 100%. That's better than the annualized TSR of 2.0% over the last three years. The improving returns to shareholders suggests the stock is becoming more popular with time. It's always interesting to track share price performance over the longer term. But to understand Mind Gym better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Mind Gym (including 1 which is significant) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance