Introducing Orocobre (ASX:ORE), The Stock That Zoomed 146% In The Last Year

Unless you borrow money to invest, the potential losses are limited. But if you pick the right stock, you can make a lot more than 100%. Take, for example Orocobre Limited (ASX:ORE). Its share price is already up an impressive 146% in the last twelve months. It's also good to see the share price up 59% over the last quarter. It is also impressive that the stock is up 31% over three years, adding to the sense that it is a real winner.

See our latest analysis for Orocobre

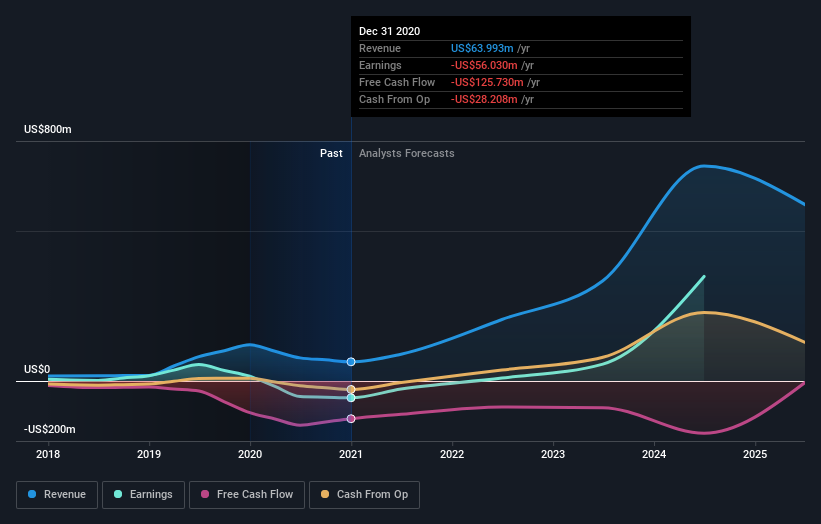

Orocobre isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Orocobre actually shrunk its revenue over the last year, with a reduction of 47%. We're a little surprised to see the share price pop 146% in the last year. It just goes to show the market doesn't always pay attention to the reported numbers. Of course, it could be that the market expected this revenue drop.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Orocobre stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Orocobre shareholders have received a total shareholder return of 146% over one year. That gain is better than the annual TSR over five years, which is 8%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Orocobre better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Orocobre .

But note: Orocobre may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance