Introducing RigNet (NASDAQ:RNET), The Stock That Tanked 73%

Long term investing works well, but it doesn’t always work for each individual stock. It hits us in the gut when we see fellow investors suffer a loss. Spare a thought for those who held RigNet, Inc. (NASDAQ:RNET) for five whole years – as the share price tanked 73%. Contrary to the longer term story, the last month has been good for stockholders, with a share price gain of 9.1%.

Check out our latest analysis for RigNet

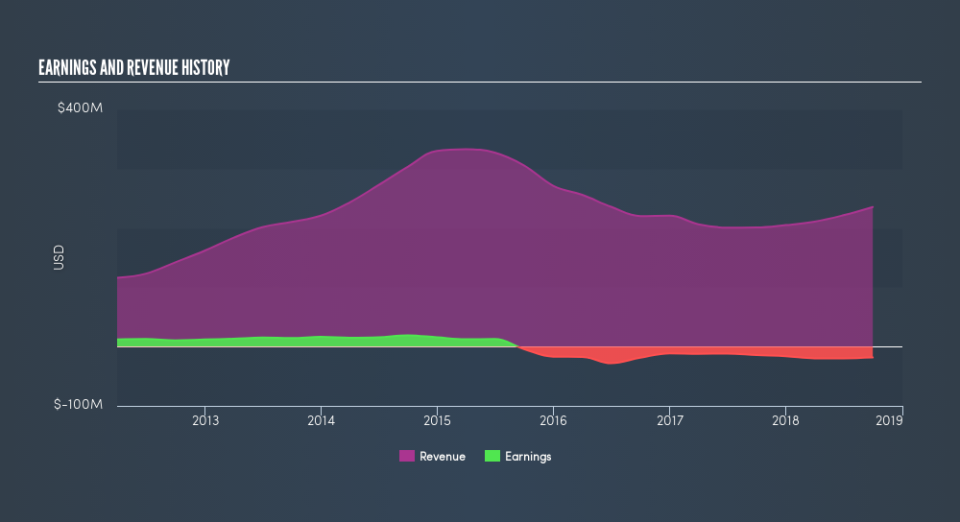

Because RigNet is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn’t make profits, we’d generally expect to see good revenue growth. That’s because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last five years RigNet saw its revenue shrink by 5.8% per year. While far from catastrophic that is not good. If a business loses money, you want it to grow, so no surprises that the share price has dropped 23% each year in that time. We’re generally averse to companies with declining revenues, but we’re not alone in that. Fear of becoming a ‘bagholder’ may be keeping people away from this stock.

Depicted in the graphic below, you’ll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

This free interactive report on RigNet’s balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It’s good to see that RigNet has rewarded shareholders with a total shareholder return of 2.8% in the last twelve months. There’s no doubt those recent returns are much better than the TSR loss of 23% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. Before spending more time on RigNet it might be wise to click here to see if insiders have been buying or selling shares.

Of course RigNet may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance