Introducing Surface Transforms (LON:SCE), A Stock That Climbed 57% In The Last Five Years

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Surface Transforms Plc (LON:SCE) shareholders might be concerned after seeing the share price drop 11% in the last quarter. Looking further back, the stock has generated good profits over five years. It has returned a market beating 57% in that time.

View our latest analysis for Surface Transforms

Because Surface Transforms is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

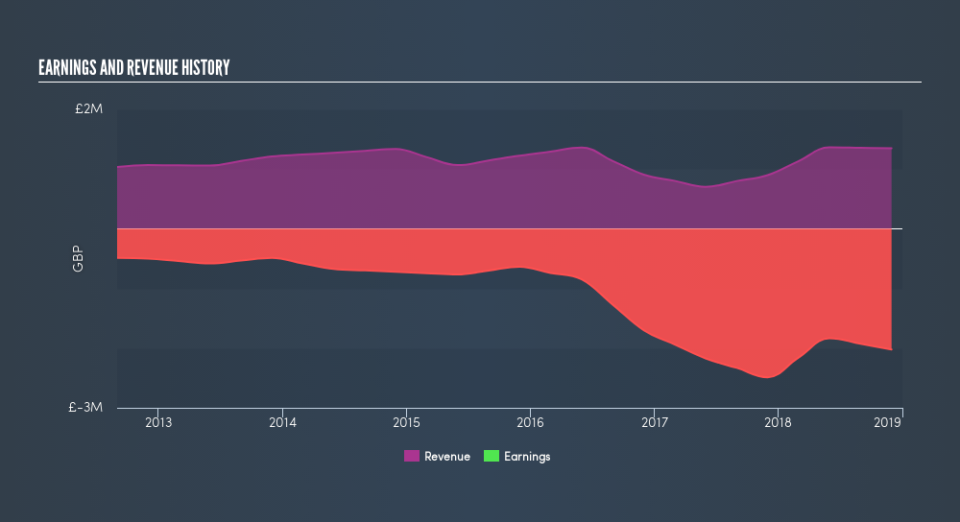

Over the last half decade Surface Transforms's revenue has actually been trending down at about 2.7% per year. Even though revenue hasn't increased, the stock actually gained 9.5%, per year, during the same period. To us that suggests that there probably isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

This free interactive report on Surface Transforms's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 0.04% in the twelve months, Surface Transforms shareholders did even worse, losing 24%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 9.5%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance