Introducing Targovax (OB:TRVX), The Stock That Tanked 75%

Over the last month the Targovax ASA (OB:TRVX) has been much stronger than before, rebounding by 64%. But that doesn't change the fact that the returns over the last half decade have been stomach churning. In fact, the share price has tumbled down a mountain to land 75% lower after that period. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The real question is whether the business can leave its past behind and improve itself over the years ahead.

View our latest analysis for Targovax

Targovax recorded just kr2,251,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, they may be hoping that Targovax comes up with a great new product, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There was already a significant chance that they would need more money for business development, and indeed they recently put themselves at the mercy of capital markets and raised equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some Targovax investors have already had a taste of the bitterness stocks like this can leave in the mouth.

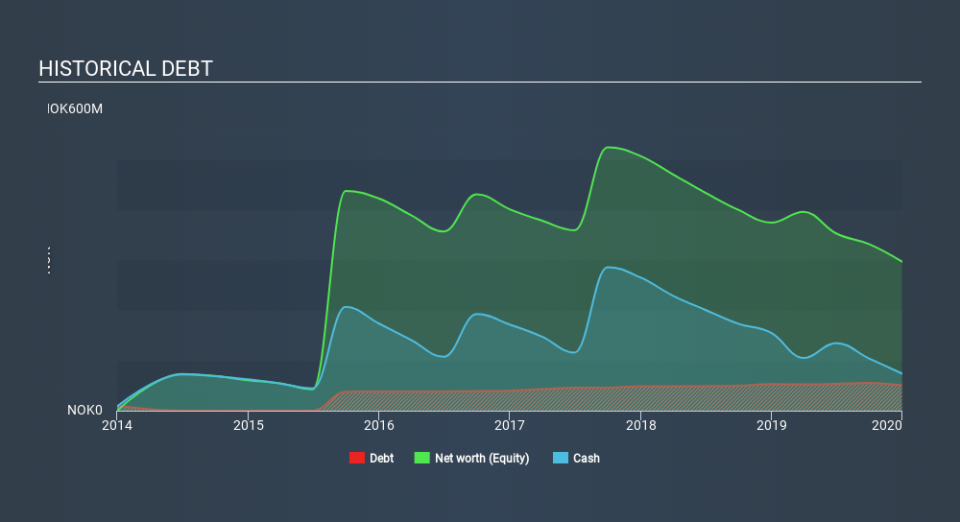

Our data indicates that Targovax had more in total liabilities than it had cash, when it last reported. That made it extremely high risk, in our view. But since the share price has dived -24% per year, over 5 years , it looks like some investors think it's time to abandon ship, so to speak, even though the cash reserves look a little better with the capital raising. You can see in the image below, how Targovax's cash levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit. Would it bother you if insiders were selling the stock? I would feel more nervous about the company if that were so. You can click here to see if there are insiders selling.

A Different Perspective

It's nice to see that Targovax shareholders have received a total shareholder return of 9.4% over the last year. Notably the five-year annualised TSR loss of 24% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 7 warning signs we've spotted with Targovax (including 3 which is are a bit unpleasant) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance