Intuit Gains 20% in a Year on Market Strength: Buy or Hold the Stock?

Intuit INTU, the financial software giant behind popular products like TurboTax and QuickBooks, has seen its stock price surge 20.9% over the past year, underperforming the Zacks Computer and Technology sector’s return of 35.1% and raising questions about its future trajectory. This impressive growth comes amid a period of economic uncertainty, suggesting that Intuit's business model and strategic positioning have resonated strongly with investors.

Intuit has an estimated 90% market share in the consumer tax preparation segment through its flagship product, TurboTax. Its QuickBooks accounting software holds a commanding 80% market share among small businesses. Its dominant market position, coupled with strong brand recognition, creates significant barriers to entry for competitors, solidifying Intuit's competitive advantage.

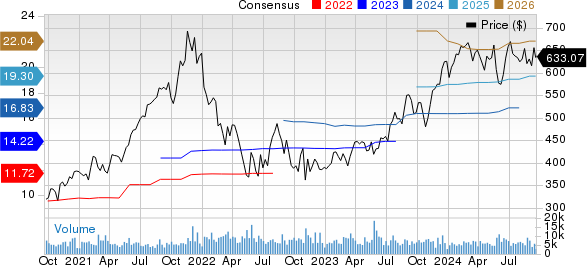

Intuit Inc. Price and Consensus

Intuit Inc. price-consensus-chart | Intuit Inc. Quote

Factors Driving INTU’s Market Dominance

The ongoing digitization of financial services, accelerated during the pandemic, is benefiting Intuit's suite of cloud-based accounting and tax preparation tools. Small businesses and individual consumers alike have increasingly turned to digital solutions to manage their finances, driving up demand for Intuit's products. In the fourth quarter of fiscal 2024, Small Business and Self-Employed Group revenues (80.3% of total revenues) grew 20% year over year to $2.55 billion.

Recently, INTU announced a major milestone to accelerate its offerings for mid-market businesses with the introduction of Intuit Enterprise Suite, a configurable suite of integrated financial products designed to seamlessly scale and enhance productivity and profitability for businesses as they grow.

Additionally, INTU's strategic acquisitions, such as Credit Karma and Mailchimp, have expanded its reach into personal finance management, credit monitoring and marketing automation. The Credit Karma business contributed $485 million to Intuit’s fiscal fourth-quarter total revenues, which increased 14% year over year, driven by strength in Credit Karma Money, credit cards, auto insurance and personal loans. Intuit expects the business unit to grow 20-25% over the long term.

Intuit's tax business has benefited from secular tailwinds like greater mobile usage and the shift to e-filing, as well as the company's effective product line extensions into expert assistance and live professional offerings.

Furthermore, INTU's continued investment in artificial intelligence and machine learning technologies presents a compelling case for investors seeking long-term growth opportunities.

INTU’s Fiscal 2025 Outlook

Intuit has been steadily shifting its customer base to subscription offerings, resulting in a predictable and recurring revenue stream. This transition not only enhances revenue visibility but also fosters customer loyalty and reduces churn rates.

Intuit projects fiscal 2025 revenues in the band of $18.160-$18.347 billion, indicating 12-13% growth. It expects fiscal 2025 non-GAAP earnings per share between $19.16 and $19.36.

The Zacks Consensus Estimate for fiscal 2025 revenues and earnings is pegged at $18.25 billion and $19.31 per share, respectively. This indicates a year-over-year improvement of 12.04% in the top line and 13.9% in the bottom line. Earnings estimates have also moved 1.3% north over the past 30 days.

Challenges Remain

While Intuit has traditionally enjoyed a dominant market position, rivals like H&R Block HRB, TaxAct and FreshBooks have been aggressively pursuing market share, leveraging innovative pricing models and enhancing digital offerings. Workday WDAY competes with INTU in the enterprise resource planning and financial management software space.

While Intuit focuses more on small to medium-sized businesses with QuickBooks, Workday targets larger enterprises with its cloud-based finance and HR solutions. Paychex PAYX competes with Intuit in the payroll and human resource services market, particularly for small to medium-sized businesses.

Additionally, the proliferation of free online tax filing services poses a threat to Intuit's TurboTax franchise, which has been a significant revenue driver. Besides, the financial software industry is subject to various regulations, and changes in these regulations could impact Intuit's business model and profitability. For instance, scrutiny by the Internal Revenue Service of the company's marketing practices for TurboTax's free edition in January this year has raised concerns about potential fines or increased oversight.

Despite its strong performance and market leadership, Intuit's stock valuation has reached lofty levels. Intuit is trading at a premium with a forward 12-month P/S of 9.57X compared with the Zacks Computer - Software industry’s 7.81X, reflecting a stretched valuation.

Here’s What Investors Should Do With INTU Stock

We believe that Intuit’s strong competitive advantages, recurring revenue model and growth potential make it well-positioned to sustain its market leadership. While Intuit's stock may not be considered a bargain in terms of its traditional valuation metrics now, investors may keep a watch on the company in view of its long-term growth prospects.

Existing investors may consider holding their positions in the stock, but new investors should wait for a more favorable entry point. Snap currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Paychex, Inc. (PAYX) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report

H&R Block, Inc. (HRB) : Free Stock Analysis Report

Workday, Inc. (WDAY) : Free Stock Analysis Report