Intuit (INTU) Up 10.5% Since Earnings Report: Can It Continue?

A month has gone by since the last earnings report for Intuit Inc. INTU. Shares have added about 10.5% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is INTU due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Intuit Q2 Results

Intuit reported third-quarter fiscal 2018 results. The company reported non-GAAP income (excluding stock-based compensation, amortization and other one-time items) from continuing operations of $4.82 per share, surpassing the Zacks Consensus Estimate of $4.67. The figure also increased 24% on a year-over-year basis.

Quarter in Detail

This tax-preparation related software maker reported revenues of $2.925 billion, up 15% from the year-ago quarter figure. The revenue figure was better than the guided range of $2.785-$2.835 billion and also outpaced the Zacks Consensus Estimate of $2.842 billion.

Services and Other revenues were up nearly 16.7% to $2.42 billion while product revenues increased 8.1% to $505 million.

Segment-wise, Small Business and Self-Employed Group witnessed 16% year-over-year growth, primarily driven by 45% subscriber growth rate for Quickbooks Online, which brought the count to 3.2 million at the end of the just reported quarter. Online ecosystem revenues surged 41%. Self-Employed subscribers increased to around 680,000 from 490,000 in the previous quarter and 360,000 in the year-ago quarter.

Geographically, U.S. based subscribers grew 40% to 2.5 million and international subscribers increased 66% on a year-over-year basis to 630,000.

Notably, revenues from Consumer Group were up 15% year over year. Revenues from Strategic Partners Group were up 4% on a year-to-date basis.

Management is particularly positive about a successful tax season backed by the performance of the DIY category and higher average revenue per return. The company also managed to gain some additional share in the DIY market. Additionally, the shift in the product mix toward the higher end of the company’s product line was also a positive.

TurboTax Live offering witnessed success in its first season and is likely to be accretive to the company’s Consumer business going ahead. The recently launched Turbo offering that provides a snapshot of a user’s financial health also witnessed healthy adoption, which is yet another positive for the expansion of the company’s business beyond tax.

The company posted non-GAAP operating income of $1.714 billion compared with $1.519 billion in the year-ago quarter. Operating margin contracted 120 basis points to 58.6% during the quarter.

Intuit posted non-GAAP net income from continuing operations of approximately $1.260 billion compared with third-quarter fiscal 2017 net income of $1.015 billion.

Balance Sheet and Cash Flow

Intuit exited fiscal third-quarter 2018 with cash and investments of $1.936 billion compared with $726 million in the prior quarter. Long-term debt was $400 million at quarter end compared with $413 million reported in the previous quarter.

Cash provided by operational activities during the first nine months of fiscal 2018 was $2.149 billion. During the quarter, the company repurchased $19 million worth of shares, with $1.2 billion still remaining under the share repurchase authorization.

The company received an authorization to pay a dividend of 39 cents per share on Jul 18, 2018.

Outlook

For the fiscal fourth quarter, the company anticipates revenues in a range of $940-$960 million.

Intuit expects fiscal fourth quarter non-GAAP operating income in the range of $75-$85 million. The company anticipates non-GAAP earnings in the band of 22–24 cents per share.

The company raised its guidance for fiscal 2018. Intuit now expects revenues of $5.915-$5.935 billion, representing an increase of 14-15% year over year. The previous guidance was $5.640-$5.740 billion, representing an increase of 9-11% year over year.

Non-GAAP earnings per share are now projected between $5.51 and $5.53, up 25%. The previous expectation was $5.30 and $5.40 per share, up 20-22%.

The non-GAAP tax rate used for calculating the guidance is 26.3%.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimate. There has been one revision higher for the current quarter compared to seven lower.

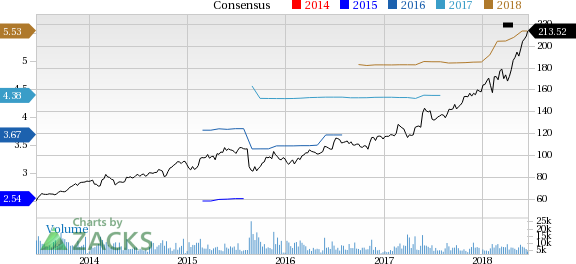

Intuit Inc. Price and Consensus

Intuit Inc. Price and Consensus | Intuit Inc. Quote

VGM Scores

At this time, INTU has a strong Growth Score of A and a grade with the same score on the momentum front. However, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Zacks' style scores indicate that the company's stock is suitable for growth and momentum investors.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of these revisions indicates a downward shift. Notably, INTU has a Zacks Rank #2 (Buy). We expect an above average return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuit Inc. (INTU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance