Intuit (INTU) Prices Senior Notes Offerings Worth $2 Billion

Intuit Inc. INTU recently announced the pricing of senior notes offering worth $2 billion. The company stated that the notes would be issued in four tranches of different maturities and carrying different interest rates as well.

The $500 million worth of senior notes will carry an annualized interest rate of 0.65% and mature in 2023. Another $500 million worth senior notes have an interest rate of 0.95% and are due in 2025. The third tranche of $500 million senior notes carries 1.35% interest and will mature in 2027. The last tranche of $500 million worth of senior notes has annualized interest rate of 1.65% and maturity in 2030.

Per the company, J.P. Morgan, BofA Securities, MUFG, US Bancorp, Wells Fargo Securities and Scotiabank are acting as joint book-running managers for the offering.

Intuit stated that it might use a portion of the net proceeds from the aforementioned offerings to finance the pending acquisition of Credit Karma. Additionally, it intends to use the remaining amount for general corporate purposes, including repayment and refinancing of debt, capital expenditures, strategic investments, and possible acquisitions.

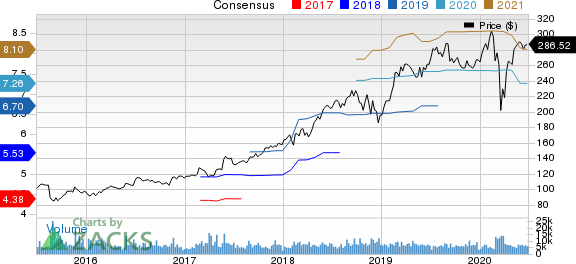

Intuit Inc. Price and Consensus

Intuit Inc. price-consensus-chart | Intuit Inc. Quote

Offering to Boost Intuit’s Financial Flexibility

Borrowing costs continue to be low, enabling companies to obtain easy financing. With the U.S. treasuries offering low rates, corporate bonds and borrowings from banks are now witnessing high demand.

We believe the latest offering will boost the company’s financial flexibility and help meet its financial obligations in an efficient way. Moreover, it provides ample scope to deploy capital for long-term growth opportunities and reward higher returns to stockholders.

At the end of third-quarter fiscal 2020, Intuit’s cash and cash equivalents totaled $3.97 billion compared with the $2.27 billion witnessed at the end of the second quarter. The company had an outstanding debt balance of approximately $350 million at the end of the fiscal third quarter.

Huge cash balance, along with the latest senior notes offerings, will provide Intuit ample liquidity and financial strength to survive amid the coronavirus crisis.

Notably, Intuit’s near-term prospects look gloomy as the global lockdown has affected small businesses, consequently posing risks to this Zacks Rank #5 (Strong Sell) company’s revenue growth. Small businesses are pushing back their payroll-related investments due to the global economic and business uncertainties caused by the pandemic.

Companies Enhancing Liquidity Amid Coronavirus Crisis

Intuit’s latest senior notes offering and sizeable liquidity position amid the coronavirus-led economic and business uncertainties bode well. In the wake of the pandemic, companies with improved liquidity can sail through these volatile times and Intuit has ensured that by enhancing the same.

Earlier this month, tech giants including HP Inc. HPQ, Palo Alto Networks, Inc. PANW and Agilent Technologies, Inc. A issued senior notes offerings worth $3 billion, $1.75 billion, and $500 million, respectively.

All three above-mentioned stocks currently carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

HP Inc. (HPQ) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance