Invesco's (IVZ) April AUM Improves on Guggenheim Acquisition

Invesco Ltd. IVZ reported preliminary month-end assets under management (AUM) of $972.8 billion for April 2018. The figure reflects an increase of 4.1% from the prior month.

The rise was mainly driven by the Guggenheim acquisition, favorable market returns, improvement in money market AUM and reinvested distributions. These were partially offset by net long-term outflows and non-management fee earning AUM outflows. Also, FX decreased April AUM by $3.6 billion.

Notably, the Guggenheim acquisition added $38.1 billion to AUM. Excluding this, AUM for the reported month remained relatively stable sequentially.

Invesco’s preliminary average total AUM for the quarter through Apr 30 was $968.7 billion while preliminary average active AUM was $735.7 billion.

At the end of the reported month, Invesco’s Equity AUM grew 6.4% from the prior month to $447.5 billion. Further, Fixed Income AUM of $236.7 billion increased 3.9% from the March 2018 level. Also, Money Market AUM was $82 billion, increasing 3% from the last month.

Additionally, Balanced AUM of $59.7 billion was stable sequentially. Alternatives AUM was also relatively stable compared with the preceding month at $146.9 billion.

While the company has been witnessing continuous growth in AUM over the last few years, supporting revenue growth, an overall challenging operating environment seems to be weighing on investors’ mind at present.

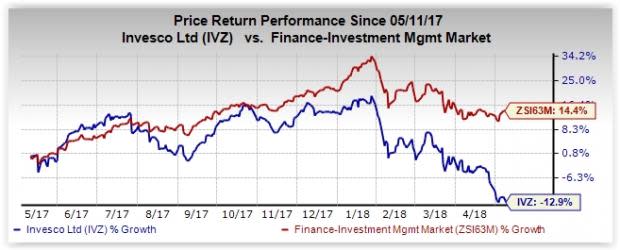

In the past year, shares of Invesco have lost 12.9% against the industry’s rally of 14.4%.

Currently, Invesco carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Apart from Invesco, Franklin Resources, Inc. BEN declared preliminary AUM of $732.5 billion by its subsidiaries for April 2018, reflecting a decline of 1% from the prior month. Further, Legg Mason, Inc. LM and T. Rowe Price Group, Inc. TROW are expected to announce AUM figures soon.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

T. Rowe Price Group, Inc. (TROW) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

Legg Mason, Inc. (LM) : Free Stock Analysis Report

Franklin Resources, Inc. (BEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance