Invesco (IVZ) Beats Q4 Earnings as Revenues and AUM Rise

Invesco Ltd. IVZ reported fourth-quarter 2017 adjusted earnings of 73 cents per share, outpacing the Zacks Consensus Estimate of 70 cents. Also, the bottom line came in 23.7% higher than the prior-year quarter.

Results were primarily supported by higher revenues and long-term net inflows. Further, the company reported a rise in assets under management (AUM). However, increase in operating expenses was an undermining factor.

On a GAAP basis, net income attributable to common shareholders came in at $408.2 million or 99 cents per share, up from $226.5 million or 55 cents per share a year ago.

For 2017, adjusted earnings per share of $2.70 beat the Zacks Consensus Estimate of $2.67 and were up 21.1% year over year. On a GAAP basis, net income attributable to common shareholders was $1.13 billion, up 32% from last year.

Revenues Rise Modestly, Expenses Up

GAAP operating revenues for the quarter were $1.38 billion, up 15.1% year over year. The figure marginally topped the Zacks Consensus Estimate of $1.37 billion. Adjusted net revenues increased 16.3% year over year to $1 billion.

For 2017, GAAP operating revenues for the quarter were $5.16 billion, up 9% year over year but lagged the Zacks Consensus Estimate of $5.21 billion. Adjusted net revenues grew 10.7% year over year to $3.75 billion.

Adjusted operating expenses were $605.7 million, up 14.8% from the prior-year quarter. The rise was due to an increase in all expense components.

Adjusted operating margin for the quarter was 39.7% compared with 38.9% a year ago.

Strong AUM

As of Dec 31, 2017, AUM grew 15.3% year over year to $937.6 billion. Average AUM for the reported quarter totaled $930.3 billion, up 15% from the year-ago quarter. Further, the reported quarter witnessed long-term net inflows of $4.4 billion.

Our View

Invesco remains well positioned to benefit from improved global investment flows supported by a diversified footprint and product offering. The company is undertaking initiatives to transform key business support functions for boosting efficiency. Also, acquisition of Source and the ETF business of Guggenheim Partners LLC (upon closure) will drive growth.

However, high-debt levels of the company might adversely affect its profitability in the long run. Further, amortization of goodwill and intangible assets remains a near-term concern for Invesco.

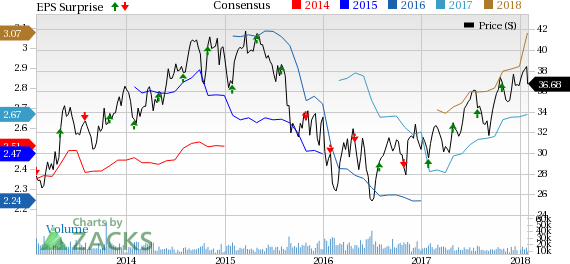

Invesco PLC Price, Consensus and EPS Surprise

Invesco PLC Price, Consensus and EPS Surprise | Invesco PLC Quote

Invesco carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Investment Managers and Upcoming Release

BlackRock, Inc.’s BLK fourth-quarter 2017 adjusted earnings of $6.24 per share outpaced the Zacks Consensus Estimate of $6.08. Results benefited from an improvement in revenues, rise in AUM and steady long-term inflows. However, increase in operating expenses acted as a headwind.

Ameriprise Financial Inc.’s AMP fourth-quarter 2017 adjusted operating earnings per share of $3.26 comfortably surpassed the Zacks Consensus Estimate of $3.09. Results benefited from an improvement in revenues as well as growth in AUM and assets under administration. However, a rise in expenses acted as a headwind.

The Blackstone Group L.P. BX is scheduled to come up with its financial numbers on Feb 1.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Invesco PLC (IVZ) : Free Stock Analysis Report

AMERIPRISE FINANCIAL SERVICES, INC. (AMP) : Free Stock Analysis Report

The Blackstone Group L.P. (BX) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance