How to invest in silver

Given the recent downturn in global stock markets, investors may be looking to diversify their portfolio by including alternative assets such as commodities.

While gold has traditionally been more popular with investors, silver may also provide a safe haven during times of economic uncertainty, as well as offering a potential hedge against high inflation rates.

Here’s a more detailed look at how to invest in silver, including the benefits of adding silver to your investment portfolio, and the options available.

Your investment can go down as well as up, and you may lose some, or all, of your money. You should seek financial advice before deciding whether to invest.

What affects the price of silver?

The price of silver is a function of global supply and demand, as with other precious metals and commodities.

Silver is highly conductive, malleable and has anti-bacterial qualities, making it widely-used in the manufacture of industrial products such as medical and electronics devices.

It’s also a key raw material in the solar energy and electric vehicle sectors and will therefore play a significant part in the global transition to clean energy and zero emissions.

Although there is a limited supply of both gold and silver, over 1.7 million metric tons of silver have been mined worldwide, compared to just 244,000 tons of gold, according to the US Geological Survey.

Due to these larger reserves, the price of silver has never reached $50 per Troy ounce (the metric used for weighing precious metals), whereas gold hit a high of over $2,000 per Troy ounce earlier this year.

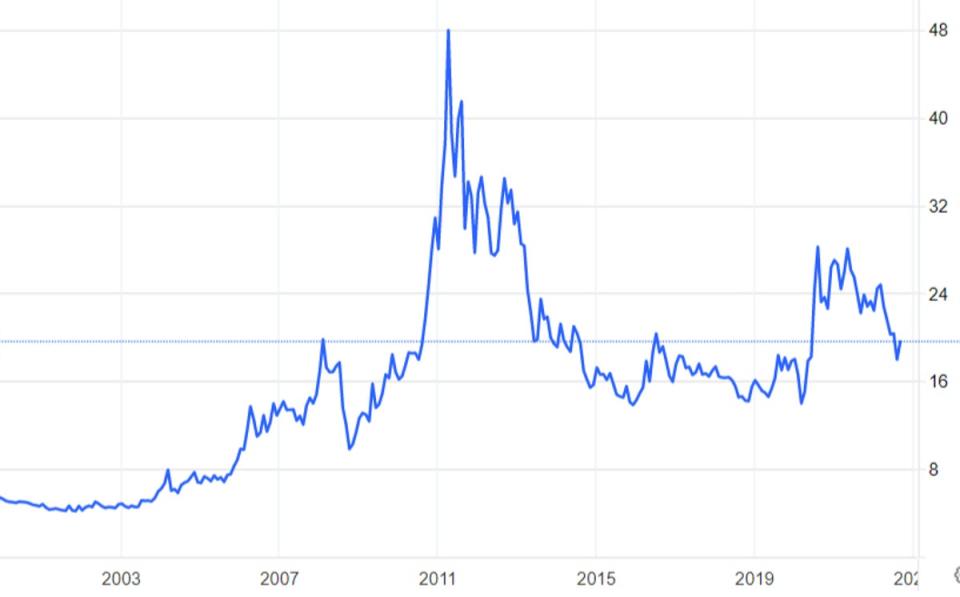

Figure 1 shows the spot price of silver (per ounce) over the last 20 years. The price of silver has increased from $5 to around $20 per Troy ounce in this period, however is currently trading some way below its 2011 high of $48.

How is the price of silver determined?

The London Bullion Market Association (LBMA) sets the benchmark price of silver in the UK. The members meet daily to agree a price that matches buyers with sellers, and this is typically used for higher-value orders.

In comparison, the spot price is a ‘live’ price principally used for buying and selling silver bullion. In addition, there is a futures market in silver, which allows the purchase and sale of silver at a specified price on a future date.

Silver is denominated in US dollars and, as a result, if the dollar weakens against other currencies, silver becomes relatively cheaper to purchase. This may increase demand, and, in turn, the price of silver.

Why invest in silver?

There are several reasons why you might choose to invest in silver, which we have outlined below.

Wealth preservation

Inflation erodes the ‘real’ value of money over a period of time, such that £100 today will buy less than it did 20 years ago. However, unlike ‘fiat’ currencies such as the British pound or US dollar, whose value is reduced by inflation, silver is a real physical asset that holds its value.

As a result, investing in silver may be a way of protecting the ‘real’ value of your wealth from being eroded by inflation. Due to this, investors often choose to hold silver when inflation is high, increasing demand, and therefore the price, of silver.

That said, gold is a better hedge against inflation than silver. Although gold is also used commercially, its main use is for investment purposes, meaning that demand for gold is higher than silver in times of high inflation.

Similarly, if high inflation occurs during a time of economic recession, a decrease in global manufacturing activity may mean an overall fall in demand for silver.

Safe haven

A currency’s value is affected by economic policies around interest rates and the supply of money. However, the price of silver is a function of global supply and demand. This means that silver tends to be a popular ‘safe haven’ during political or economic instability.

For example, silver prices rose by 140% in the three months to August 2020, as investors looked for an alternative asset class due to the downturn in global stock markets from the pandemic. The price of silver also increased by 10% in the fortnight after Russia invaded Ukraine.

Diversification

In addition to cash, shares, property and bonds, silver provides another asset to diversify an investment portfolio. Diversification helps to protect against the risk of one asset, such as shares, underperforming.

However, while the price of gold tends to be inversely related to the stock market, this is not the case for silver. Or, put another way, the price of silver has not usually risen when stock markets have fallen.

Disadvantages of investing in silver

Due to the lower trading volumes, the price of silver is more volatile than gold, which can increase both profits and losses. This can be problematic if investors want to sell silver during a period of depressed prices.

Furthermore, silver does not produce any income for investors, unlike savings, bonds and dividend-paying shares.

It is also difficult to hold silver in physical form as it can tarnish and investors will have to hold a relatively larger volume of silver than gold, due to its lower value. Investors will also need to check the authenticity of the silver, store it in a secure location with suitable insurance, and find a buyer when they wish to sell it.

How can you invest in silver?

You can invest in silver either in physical form, or indirectly through a silver-related investment product.

Buying physical silver

The value of silver is based on its purity or fineness, using the millesimal system (rather than carats for gold). This measures the purity in parts per thousand, including fine or pure silver (999) Britannia silver (958) and sterling silver (925).

There are three main way of buying physical silver, from the Royal Mint and metal dealers:

Coins: the Britannia is the flagship coin offered by The Royal Mint, with a one ounce Britannia 999 fine silver coin currently costing £24. UK residents are not required to pay capital gains tax on silver Britannia coins as they are legal tender however, unlike the gold Britannia and Sovereign coins, VAT will be charged on the purchase

Bullion bars: bars vary in weight from one ounce to over 10 kilograms and are stamped with the weight and purity level. The Royal Mint currently charges £682 for a one kilogram 999 fine silver bullion bar.

Jewellery: you’ll usually pay a minimum mark-up of at least 20% relative to the value of the silver, and often far higher, due to the cost of the jewellery’s design and production. It is possible to calculate this mark-up by looking up the spot price of silver based on the weight and purity of the item.

It’s important to buy silver either from the Royal Mint or a reputable dealer. One option is to check whether the dealer is a Member of the British Numismatic Trade Association who are required to comply with a code of ethics for metals trading.

You should also calculate the cost of insurance and fees for storing silver in a third party’s vault or safety deposit box. For example, it costs 1-2% (plus VAT) per year to store silver in The Royal Mint’s vaults, based on the value of the silver stored.

Buying exchange-traded products (ETPs)

A simple way of investing indirectly in silver is through exchange-traded funds (ETFs) and exchange-traded commodities (ETCs). Some ETPs hold the silver in physical form, or via futures contracts, while other funds replicate a broader precious metals index.

These are a low-cost way of tracking the price of silver or a basket of commodities, and typically charge annual management fees of around 0.1 to 0.2% compared to 0.5% to 1.0% for actively-managed funds.

By way of example, the Invesco Physical Silver and iShares Physical Silver ETCs have both achieved 5-year total returns of 28% and charge an annual management fee of 0.2%, according to Trustnet.

Buying silver funds

Silver funds generally invest in companies involved in the mining of silver, rather than the underlying commodity itself. These companies benefit from a rise in the price of silver as it increases their revenue.

Silver funds include the Jupiter Gold And Silver fund which has delivered a five-year return of 19%, according to Trustnet. Around three-quarters of the fund is invested in equities, with around 20% in bullion itself, and it charges an annual management fee of 1.1%.

Alternatively, the broader-based Blackrock World Mining fund has achieved a five-year return of 75%, investing in large mining companies such as Glencore and BHP. However, it charges a higher annual management fee of 1.3%.

Buying shares in silver mining companies

Investors may also want to consider buying shares in companies that mine and trade silver given that their share prices are highly correlated to the price of silver. However, other factors also impact the overall performance of these companies, along with the wider geopolitical and environmental conditions.

Shareholders in mining companies may make a profit from a rise in share price, along with a source of income from dividends. According to trading platform AJ Bell, there was a £10 billion increase in dividends paid by mining companies in 2021, due to soaring commodity prices.

However, there are very few ‘pure play’ silver mining companies. First Majestic Silver Corp (FR) is headquartered in Canada and generates revenue equally from gold and silver mining. Wheaton Precious Metals (WPM) is also Canadian but is a streaming company that provides financing to mining companies in return for the option of buying metals such as gold and silver at fixed prices.

Although FTSE mining giants BHP (BHP) and Rio Tinto (RIO) have smaller-scale silver production operations, they are currently trading at attractive dividend yields (the dividend divided by the share price) of 13% and 11% respectively. A dividend yield is a proxy for the annual return that shareholders are likely to receive in the form of dividends.

Should you invest in silver?

Silver may provide a partial hedge against inflation, a relative safe haven and enable investors to diversify their portfolio across a different asset class.

Although the current price is over 40% lower than a decade ago, investors buying silver at the lowest price ($11) and selling at the highest price ($28) during this period would have achieved a profit of over 150%.

Depending on your appetite for risk, options include investing in physical silver, shares in mining companies or silver-based funds and ETFs.

However, any direct or indirect investment in silver should form part of a balanced portfolio and commodities should not represent more than around 5% of your overall portfolio due to their price volatility.

Yahoo Finance

Yahoo Finance