Investing in Lucero Energy (CVE:LOU) three years ago would have delivered you a 560% gain

Generally speaking, investors are inspired to be stock pickers by the potential to find the big winners. But when you hold the right stock for the right time period, the rewards can be truly huge. Take, for example, the Lucero Energy Corp. (CVE:LOU) share price, which skyrocketed 560% over three years. It's also good to see the share price up 22% over the last quarter. We love happy stories like this one. The company should be really proud of that performance!

So let's assess the underlying fundamentals over the last 3 years and see if they've moved in lock-step with shareholder returns.

Check out our latest analysis for Lucero Energy

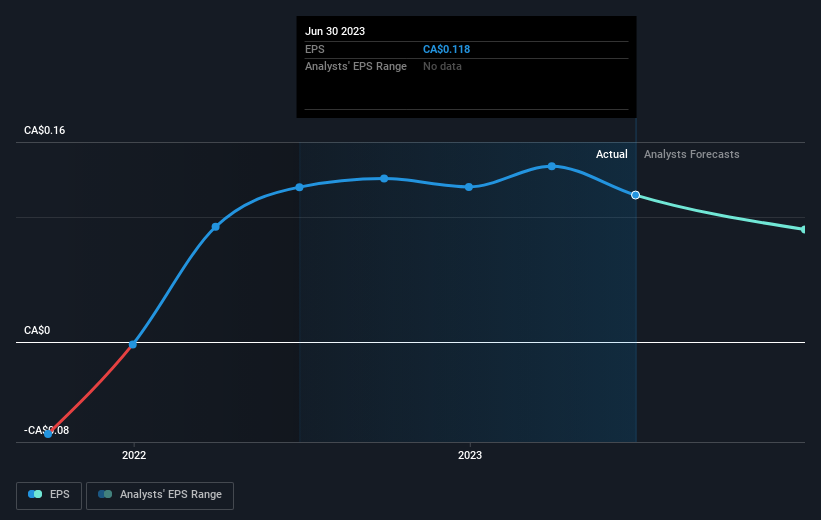

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Lucero Energy became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Lucero Energy has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Lucero Energy's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Lucero Energy shareholders have received a total shareholder return of 6.5% over the last year. Notably the five-year annualised TSR loss of 10% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance