Investment banks had their worst start to the year since 2009

REUTERS/Rafael Marchante

Investment banks are facing their worst year since the 2008 financial crisis.

While the focus has been on European banks – Credit Suisse has said it will most likely post a 40% to 45% drop in markets revenues, while Deutsche Bank missed ambitious targets in its rates trading division – no one has been immune.

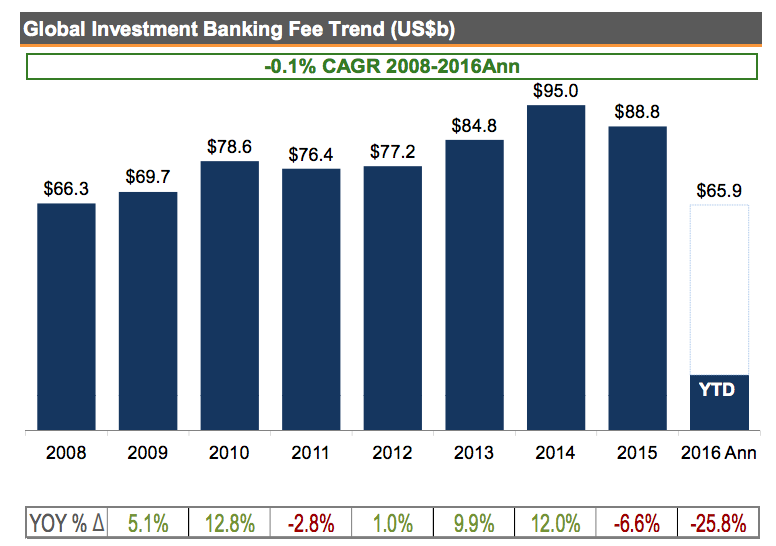

Overall, fees for investment banking services, which include M&A advice and capital markets underwriting are down 29% in the first quarter this year compared to last year.

Investment banks collected $16.2 billion (£11.3 billion) in fee revenue, according to Thomson Reuters, which marks the worst start to the year since 2009 – a point at which the industry was in turmoil following the collapse of Lehman Brothers in 2008.

Here's how it looks on the chart:

REUTERS/Rafael Marchante

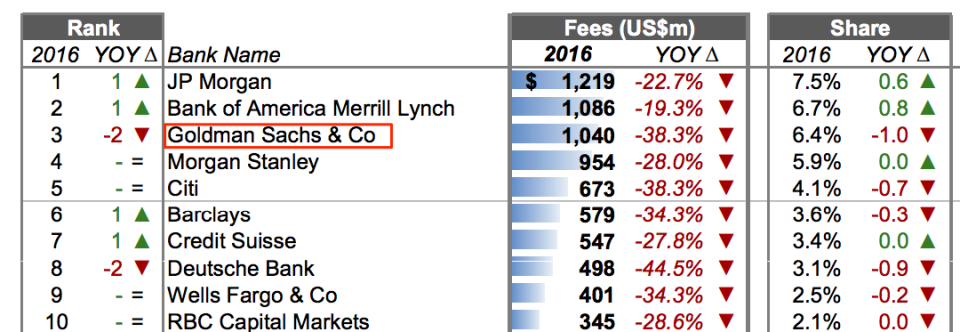

While the woes at Deutsche Bank and Credit Suisse have been the most public, other big names have had a bad start to the year.

Goldman Sachs was pipped to the top spot for the first quarter by JP Morgan, falling back two places to third after Bank of America Merrill Lynch. Despite a strong showing in M&A advice, Goldman's investment bank fee revenue was down more than 38% at the start of 2016, registering just over $1 billion.

Here's the chart for the top 10:

REUTERS/Rafael Marchante

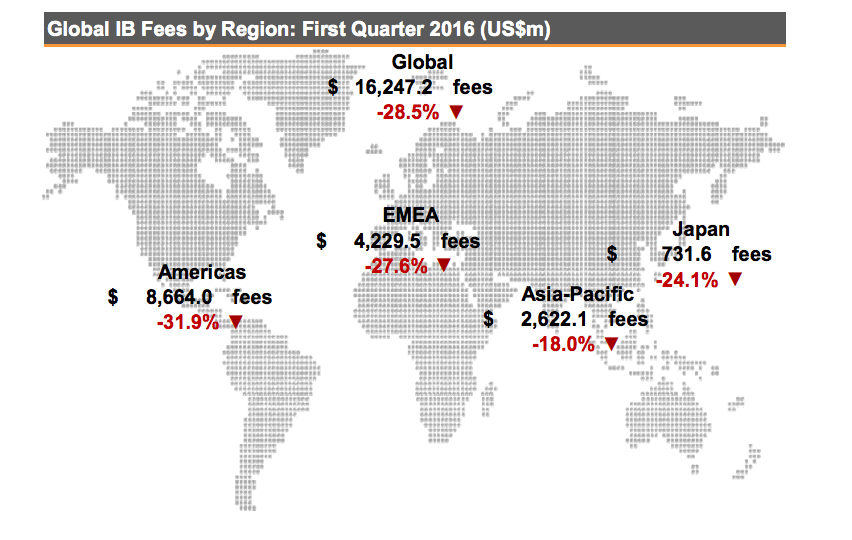

And here's the global picture, which looks dire in every major region:

REUTERS/Rafael Marchante

NOW WATCH: The secret to selling your house for more money

See Also:

DEUTSCHE BANK: Get ready for a junk-bond default cycle to start in 2017

Lloyd Blankfein explains a new strategy at Goldman that's great news for young people

SEE ALSO: A key trading business at Deutsche Bank is suffering

Yahoo Finance

Yahoo Finance