Investors Who Bought Beacon Roofing Supply (NASDAQ:BECN) Shares Five Years Ago Are Now Up 35%

The main point of investing for the long term is to make money. But more than that, you probably want to see it rise more than the market average. Unfortunately for shareholders, while the Beacon Roofing Supply, Inc. (NASDAQ:BECN) share price is up 35% in the last five years, that's less than the market return. The last year hasn't been great either, with the stock up just 1.1%.

Check out our latest analysis for Beacon Roofing Supply

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Beacon Roofing Supply actually saw its EPS drop 18% per year. This was, in part, due to extraordinary items impacting earning in the last twelve months.

This means it's unlikely the market is judging the company based on earnings growth. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

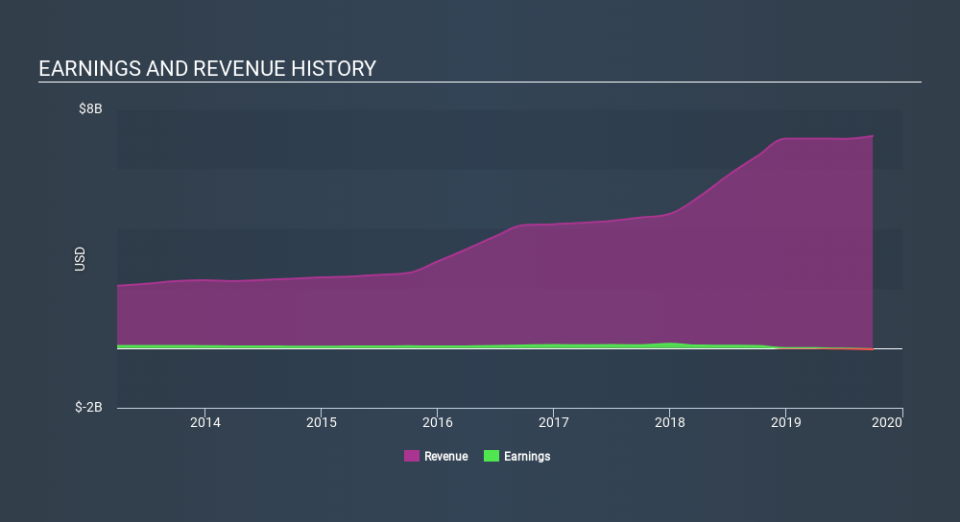

On the other hand, Beacon Roofing Supply's revenue is growing nicely, at a compound rate of 24% over the last five years. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Beacon Roofing Supply in this interactive graph of future profit estimates.

A Different Perspective

Beacon Roofing Supply shareholders are up 1.1% for the year. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 6.2% per year for five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Beacon Roofing Supply by clicking this link.

Beacon Roofing Supply is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance