Investors Who Bought Birmingham Sports Holdings (HKG:2309) Shares Five Years Ago Are Now Down 89%

Some stocks are best avoided. We really hate to see fellow investors lose their hard-earned money. Spare a thought for those who held Birmingham Sports Holdings Limited (HKG:2309) for five whole years - as the share price tanked 89%. The falls have accelerated recently, with the share price down 22% in the last three months.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for Birmingham Sports Holdings

Birmingham Sports Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

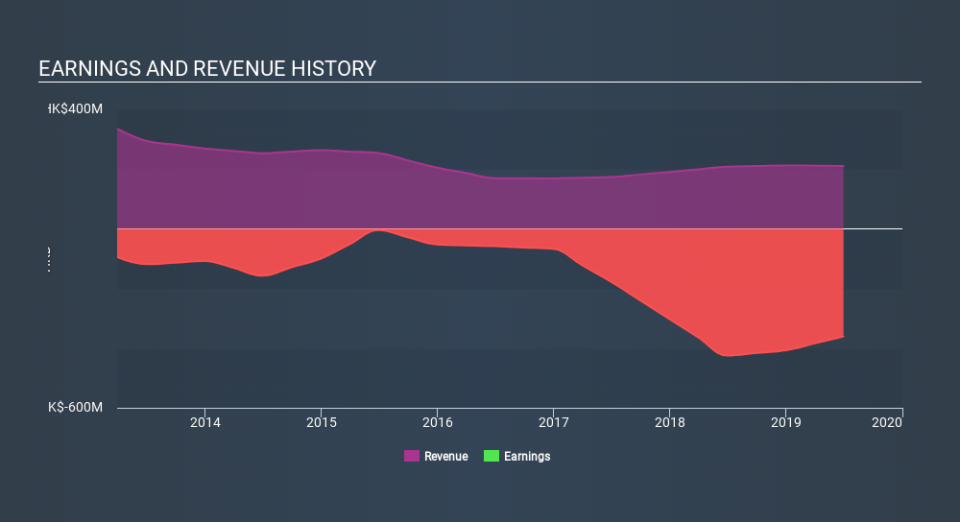

In the last five years Birmingham Sports Holdings saw its revenue shrink by 5.2% per year. That's not what investors generally want to see. If a business loses money, you want it to grow, so no surprises that the share price has dropped 35% each year in that time. We're generally averse to companies with declining revenues, but we're not alone in that. Fear of becoming a 'bagholder' may be keeping people away from this stock.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Birmingham Sports Holdings stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Birmingham Sports Holdings's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Birmingham Sports Holdings hasn't been paying dividends, but its TSR of -87% exceeds its share price return of -89%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that Birmingham Sports Holdings shareholders have received a total shareholder return of 81% over the last year. Notably the five-year annualised TSR loss of 34% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 5 warning signs for Birmingham Sports Holdings you should be aware of, and 3 of them are a bit unpleasant.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance