Investors Who Bought COSCO Shipping International (Singapore) (SGX:F83) Shares Five Years Ago Are Now Down 47%

COSCO Shipping International (Singapore) Co., Ltd. (SGX:F83) shareholders should be happy to see the share price up 15% in the last month. But if you look at the last five years the returns have not been good. You would have done a lot better buying an index fund, since the stock has dropped 47% in that half decade.

See our latest analysis for COSCO Shipping International (Singapore)

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, COSCO Shipping International (Singapore) moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

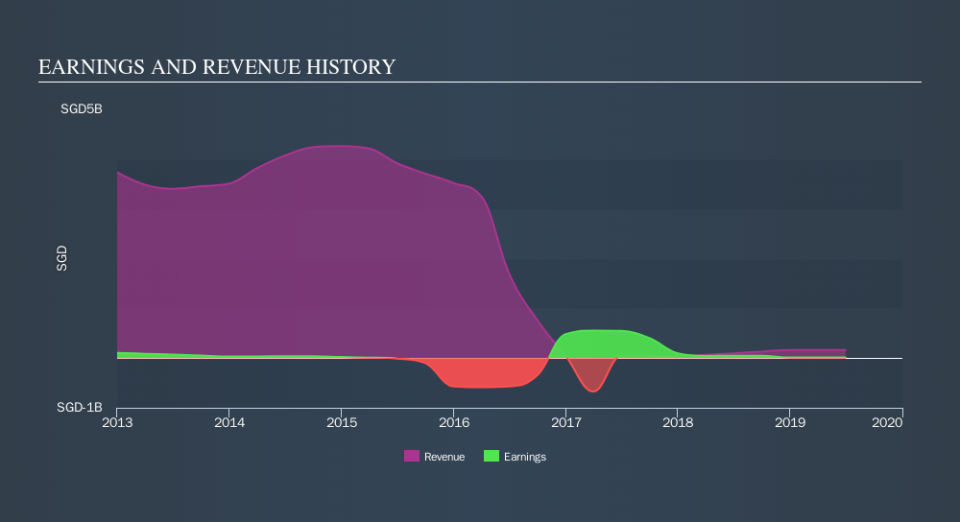

Arguably, the revenue drop of 64% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on COSCO Shipping International (Singapore)'s balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

COSCO Shipping International (Singapore) shareholders are down 13% for the year, but the market itself is up 8.8%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Is COSCO Shipping International (Singapore) cheap compared to other companies? These 3 valuation measures might help you decide.

Of course COSCO Shipping International (Singapore) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance