Investors Who Bought Iofina (LON:IOF) Shares Five Years Ago Are Now Down 55%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

This week we saw the Iofina plc (LON:IOF) share price climb by 16%. But that doesn't change the fact that the returns over the last half decade have been disappointing. In that time the share price has delivered a rude shock to holders, who find themselves down 55% after a long stretch. So we're not so sure if the recent bounce should be celebrated. Of course, this could be the start of a turnaround.

See our latest analysis for Iofina

Given that Iofina didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

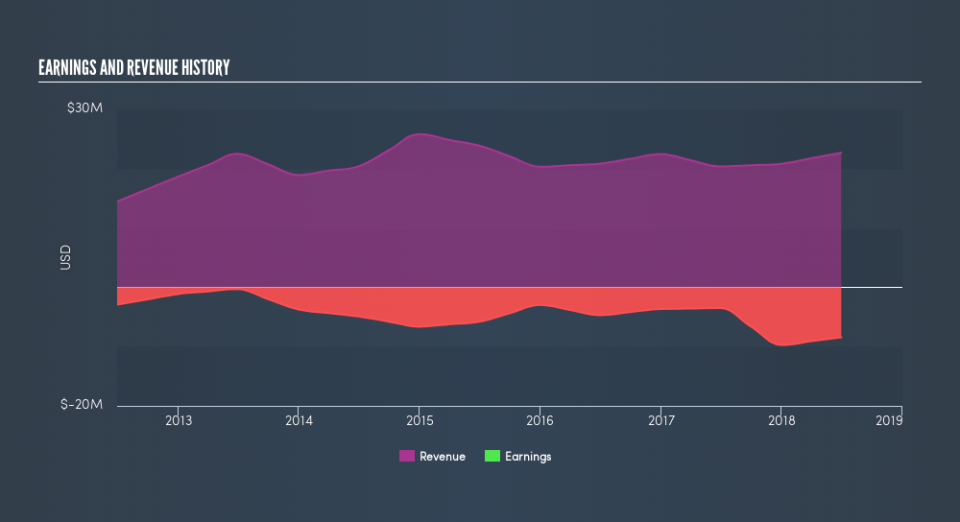

In the last five years Iofina saw its revenue shrink by 0.2% per year. That's not what investors generally want to see. The share price decline of 15% compound, over five years, is understandable given the company is losing money, and revenue is moving in the wrong direction. The chance of imminent investor enthusiasm for this stock seems slimmer than Louise Brooks. Ultimately, it may be worth watching - should revenue pick up, the share price might follow.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 2.7% in the last year, Iofina shareholders lost 0.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 15% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. You could get a better understanding of Iofina's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

We will like Iofina better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance