Investors Who Bought PL Group (WSE:PLG) Shares Three Years Ago Are Now Up 548%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

PL Group S.A. (WSE:PLG) shareholders might understandably be very concerned that the share price has dropped 31% in the last quarter. But over the last three years the stock has shone bright like a diamond. Over that time, we've been excited to watch the share price climb an impressive 548%. So you might argue that the recent reduction in the share price is unremarkable in light of the longer term performance. The share price action could signify that the business itself is dramatically improved, in that time.

We love happy stories like this one. The company should be really proud of that performance!

View our latest analysis for PL Group

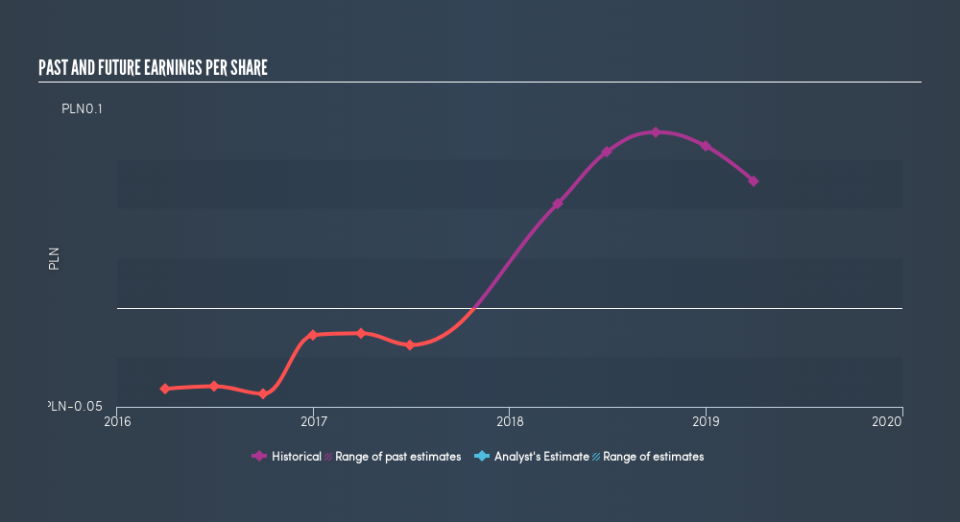

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

PL Group became profitable within the last three years. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on PL Group's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that PL Group shareholders have received a total shareholder return of 1.3% over one year. However, the TSR over five years, coming in at 20% per year, is even more impressive. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. Before deciding if you like the current share price, check how PL Group scores on these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance