Investors Who Bought Surface Transforms (LON:SCE) Shares Five Years Ago Are Now Up 83%

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, long term Surface Transforms Plc (LON:SCE) shareholders have enjoyed a 83% share price rise over the last half decade, well in excess of the market return of around 3.2% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 63% in the last year.

View our latest analysis for Surface Transforms

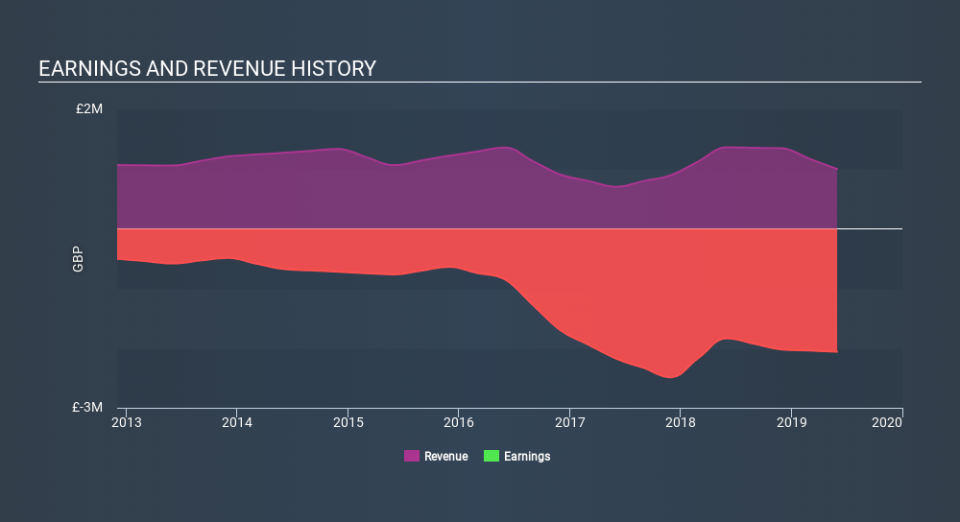

Surface Transforms isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Surface Transforms saw its revenue shrink by 2.5% per year. Even though revenue hasn't increased, the stock actually gained 13%, per year, during the same period. It's probably worth checking other factors such as the profitability, to try to understand the share price action. It may not be reflecting the revenue.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Surface Transforms's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Surface Transforms shareholders have received a total shareholder return of 63% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 13% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance