Investors Who Bought Tissue Regenix Group (LON:TRX) Shares Five Years Ago Are Now Down 86%

Long term investing works well, but it doesn't always work for each individual stock. We don't wish catastrophic capital loss on anyone. For example, we sympathize with anyone who was caught holding Tissue Regenix Group plc (LON:TRX) during the five years that saw its share price drop a whopping 86%. And it's not just long term holders hurting, because the stock is down 60% in the last year. The falls have accelerated recently, with the share price down 40% in the last three months.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Tissue Regenix Group

Because Tissue Regenix Group is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

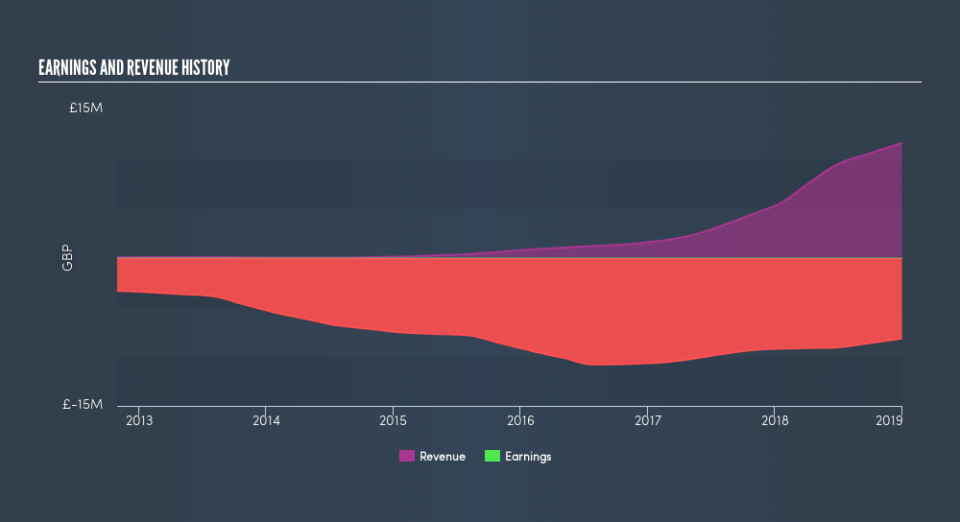

In the last half decade, Tissue Regenix Group saw its revenue increase by 79% per year. That's well above most other pre-profit companies. So on the face of it we're really surprised to see the share price has averaged a fall of 32% each year, in the same time period. You'd have to assume the market is worried that profits won't come soon enough. While there might be an opportunity here, you'd want to take a close look at the balance sheet strength.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Tissue Regenix Group shareholders are down 60% for the year, but the market itself is up 1.4%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 32% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of Tissue Regenix Group's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Tissue Regenix Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance