Investors Who Bought Zogenix (NASDAQ:ZGNX) Shares Five Years Ago Are Now Up 411%

We think all investors should try to buy and hold high quality multi-year winners. While not every stock performs well, when investors win, they can win big. Just think about the savvy investors who held Zogenix, Inc. (NASDAQ:ZGNX) shares for the last five years, while they gained 411%. If that doesn't get you thinking about long term investing, we don't know what will. Meanwhile the share price is 4.4% higher than it was a week ago.

View our latest analysis for Zogenix

Given that Zogenix didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last half decade Zogenix's revenue has actually been trending down at about 35% per year. So it's pretty surprising to see that the share price is up 39% per year. Obviously, whatever the market is excited about, it's not a track record of revenue growth. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

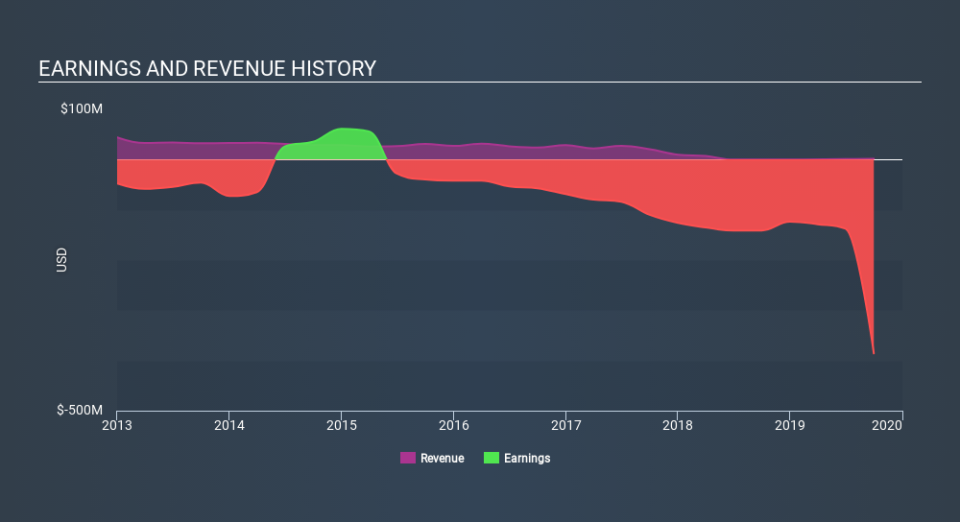

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Zogenix is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Zogenix in this interactive graph of future profit estimates.

A Different Perspective

Zogenix shareholders are up 11% for the year. But that was short of the market average. On the bright side, the longer term returns (running at about 39% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. If you would like to research Zogenix in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

But note: Zogenix may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance