Investors in Destiny Pharma (LON:DEST) have unfortunately lost 43% over the last five years

Destiny Pharma plc (LON:DEST) shareholders will doubtless be very grateful to see the share price up 83% in the last quarter. But over the last half decade, the stock has not performed well. After all, the share price is down 43% in that time, significantly under-performing the market.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

See our latest analysis for Destiny Pharma

We don't think Destiny Pharma's revenue of UK£986,051 is enough to establish significant demand. You have to wonder why venture capitalists aren't funding it. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that Destiny Pharma has the funding to invent a new product before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt.

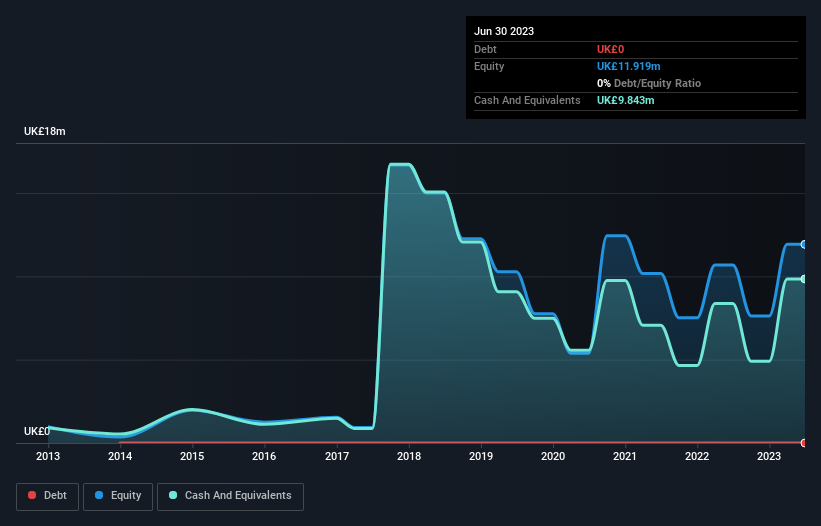

When it last reported its balance sheet in June 2023, Destiny Pharma had cash in excess of all liabilities of UK£8.7m. While that's nothing to panic about, there is some possibility the company will raise more capital, especially if profits are not imminent. With the share price down 7% per year, over 5 years , it seems likely that the need for cash is weighing on investors' minds. You can click on the image below to see (in greater detail) how Destiny Pharma's cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? It would bother me, that's for sure. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

We're pleased to report that Destiny Pharma shareholders have received a total shareholder return of 41% over one year. That certainly beats the loss of about 7% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Destiny Pharma has 6 warning signs (and 1 which shouldn't be ignored) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance