Investors Don't See Light At End Of HanseYachts AG's (ETR:H9Y) Tunnel And Push Stock Down 30%

Unfortunately for some shareholders, the HanseYachts AG (ETR:H9Y) share price has dived 30% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 47% in that time.

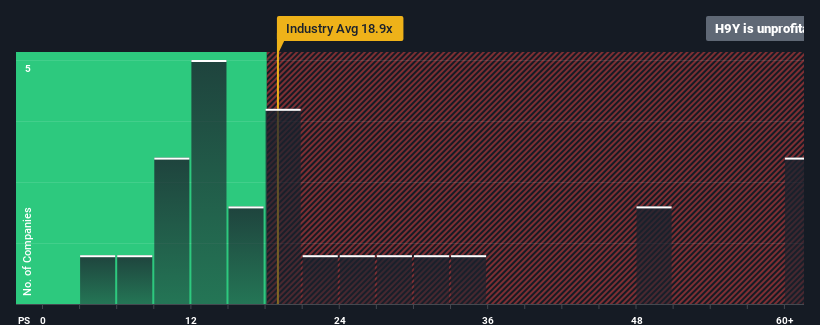

Since its price has dipped substantially, HanseYachts' price-to-earnings (or "P/E") ratio of -1.6x might make it look like a strong buy right now compared to the market in Germany, where around half of the companies have P/E ratios above 17x and even P/E's above 35x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

As an illustration, earnings have deteriorated at HanseYachts over the last year, which is not ideal at all. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for HanseYachts

Although there are no analyst estimates available for HanseYachts, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

How Is HanseYachts' Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like HanseYachts' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 1,521%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 12% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why HanseYachts is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On HanseYachts' P/E

HanseYachts' P/E looks about as weak as its stock price lately. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of HanseYachts revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 4 warning signs for HanseYachts you should be aware of, and 3 of them don't sit too well with us.

If you're unsure about the strength of HanseYachts' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance