Investors dumped emerging market stocks right before the sell-off went global

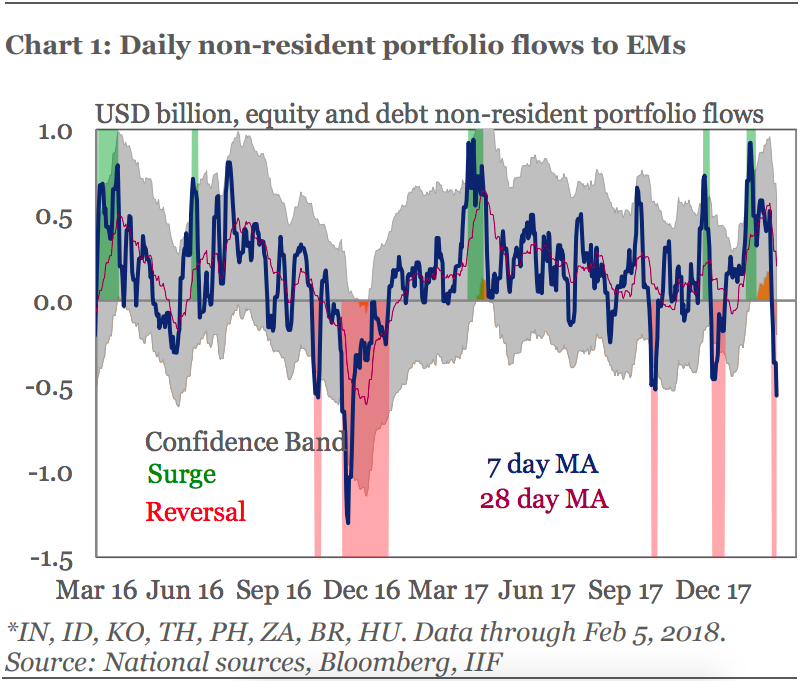

A report from the Institute of International Finance (IIF) shows heavy selling in emerging market (EM) equities began on Jan. 30, with overall EM funds shedding $4 billion. That was before Friday’s 666-point loss in the Dow and Monday’s more than 1100-point drop.

The data suggests emerging markets stocks may be leading the way for U.S. and European equities as risk appetite has grown in markets. However, IIF Senior Director of Global Capital Markets Sonja Gibbs warns that investors ought not get ahead of themselves because of the data. She asserts that emerging markets continue to lag rather than lead developed markets in stock performance, as investors still sell them when fear overtakes the market.

“Rightly or wrongly, EMs tend to fall into the ‘risk’ bucket — though there are signs that investors are becoming more discriminating,” Gibbs told Yahoo Finance in an email Monday night.

EM stocks and bond values grew in January, exceeding the rise in U.S. markets, much as they had during 2017. However, beginning on Jan. 30, portfolio flows to emerging markets have seen a sharp downturn, recording the largest fall since the 2016 U.S. presidential election when Donald Trump’s election victory was expected to rock risk markets and undercut several emerging market countries’ growth prospects.

Trump’s campaign promises to reduce trade and enact protectionist policies saw emerging markets’ assets plunge, only to recover as global growth expectations were revised higher and the prospect of lower taxes and fiscal stimulus in the U.S. pushed risk assets to all-time highs.

“When you have such an abrupt swing—feast to famine in this case given the strength of flows during much of January—it’s going to make people look more closely,” Gibbs said.

The U.S. stock market slide began on Friday, two days after IIF first noted the outflows from EM.

IIF analysts also noted in their report that most of the $4 billion loss from emerging markets – some $3.4 billion – had been outflows from equities.

Stocks have been far more volatile than bonds in emerging markets and have notched much more significant outflows since last year, IIF noted. The organization, which surveys banks and financial institutions with large presences in emerging market countries like Brazil, India and China, pointed out that it remains positive on emerging market investments but does see risk ahead for investors.

“[W]hile we remain generally optimistic on EM flows this year, downside risks should not be understated,” the report noted. “A sustained global equity market selloff would clearly be one such downside risk.”

IIF also noted that the selloff has been mostly in stocks and has targeted particular countries with appetite for Indian stocks and bonds, as well as assets in Brazil and South Africa remaining solid.

Still, Gibbs doesn’t expect the strong selling in emerging markets to put a damper on the long-term trend.

Emerging markets “have been unloved, under-owned and undervalued; however, investors became much more positive in 2017 and in early 2018,” Gibbs told Yahoo Finance. “Looking ahead, further opening of China’s domestic bond and stock markets will be an absolute game changer.”

Yahoo Finance

Yahoo Finance