Investors Eye a Niche Bond to Access Highest EM Policy Rate

(Bloomberg) -- Demand for Turkish lira assets has become so strong this year that some foreign investors are venturing into little-known and illiquid bonds.

Most Read from Bloomberg

Real Estate Investors Are Wiped Out in Bets Fueled by Wall Street Loans

Putin’s Wartime Central Banker Tells Him What He Doesn’t Want to Hear

GameStop Slumps on Share Sale Plan as Gill Makes YouTube Return

The so-called TLREF notes, indexed to the overnight reference rate set by the Turkish central bank, are becoming increasingly popular among a subset of investors on the hunt for extraordinary yields in emerging markets. The bills are relatively difficult for foreigners to attain or sell as they’re primarily held by local banks for balance-sheet management purposes rather than trading.

Yet despite the lack of a secondary market, overseas investors see them as attractive because they offer a premium over the central bank’s policy rate of 50%, which is the highest in the world after frontier market Venezuela. That rate is well above other super high-yield markets including Argentina, at 40%, and Zimbabwe, at 20%.

Traders say offshore investors are increasingly making deals to buy the bills from local banks and asset-management firms as they seek ways around regulations that limit their access to higher domestic yields. Turkey’s rules are designed to restrict the amount of swaps that local banks can extend overseas. The traders asked not to identified as the transactions are private.

“Foreign investors are likely to be more keen to find alternative ways to place lira with higher nominal yield levels, where TLREF-indexed bonds may stand out,” said Onur Ilgen, head of Treasury at MUFG Bank Turkey in Istanbul.

Banco Bilbao Vizcaya Argentaria SA also recommends its clients buy the notes. “As the central bank maintains its tight monetary stance and its commitment to real appreciation in the lira becomes more convincing, TLREF-indexed bonds are still attractive,” Tufan Comert, BBVA’s strategy director for the Middle East and North Africa, wrote in a note.

The TLREF notes usually pay a coupon every three months. The Turkish lira overnight reference rate linked to them was set at 50.3% as of Thursday, while yields on conventional fixed-rate two- and 10-year government bonds were lower at 41.8% and 27.7% respectively. However, these markets are more liquid than for TLREF assets, which may prove hard to offload for foreigners.

Turkey’s U-turn

Turkey is prioritizing reopening its markets to foreign funds, having overhauled economic policies and appointed a team of investor-friendly officials following elections last year. That’s a dramatic turnaround following a years-long experiment with unconventional policies based on ultra-low interest rates, which sent investors fleeing and the lira to record lows.

The risk of further reversals by President Recep Tayyip Erdogan is still keeping some money managers away from the country, with memories fresh of a central bank governor being removed earlier this year — the fifth since 2019. Turkey’s five-year credit default swaps rate, a gauge of its default risk, is the sixth highest among emerging markets.

This year, the changes have started to yield some results. Carry investors are buying into the policy turnaround and pouring billions of dollars into lira assets, taking advantage of the high yields and a currency that’s been stable for three months.

Total foreign holdings of Turkish lira-denominated government bonds have risen 10-fold in a year to $10 billion. That remains well down from $70 billion more than a decade ago.

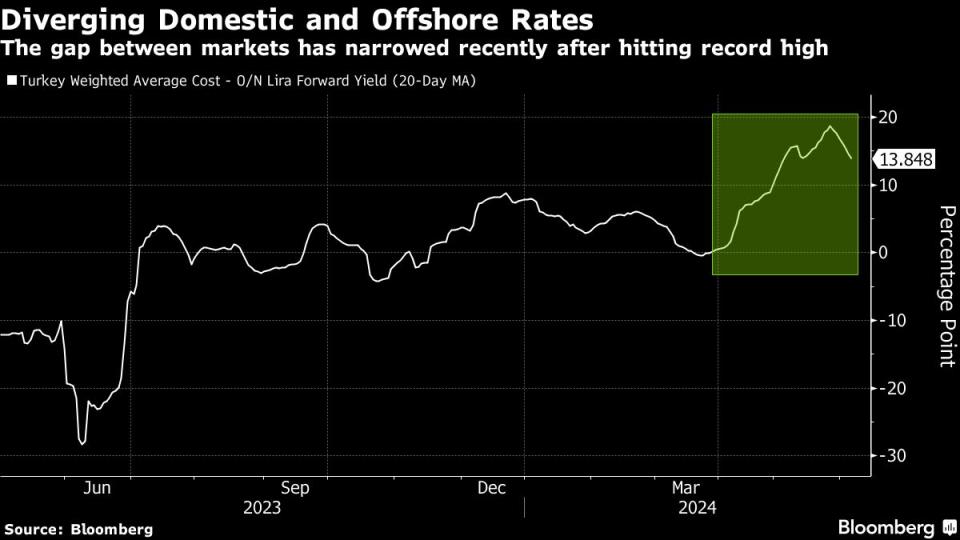

Still, there are limits for keen investors. Growing demand for liras abroad has pushed offshore rates well below domestic yields, further incentivizing foreign investors to access more niche instruments like the TLREF bonds with higher returns.

“It feels like Turkish policymakers have made an unwritten commitment to ensure early carry investors do not regret their decisions,” said Emre Akcakmak, a senior consultant at East Capital International AB in Dubai.

(Updates with BBVA comments in sixth paragraph.)

Most Read from Bloomberg Businessweek

Sam Altman Was Bending the World to His Will Long Before OpenAI

Legacy Airlines Are Thriving With Ultracheap Fares, Crushing Budget Carriers

David Sacks Tried the 2024 Alternatives. Now He’s All-In on Trump

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance