How Should Investors Feel About Tavistock Investments' (LON:TAVI) CEO Remuneration?

Brian Raven is the CEO of Tavistock Investments Plc (LON:TAVI), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Tavistock Investments

Comparing Tavistock Investments Plc's CEO Compensation With the industry

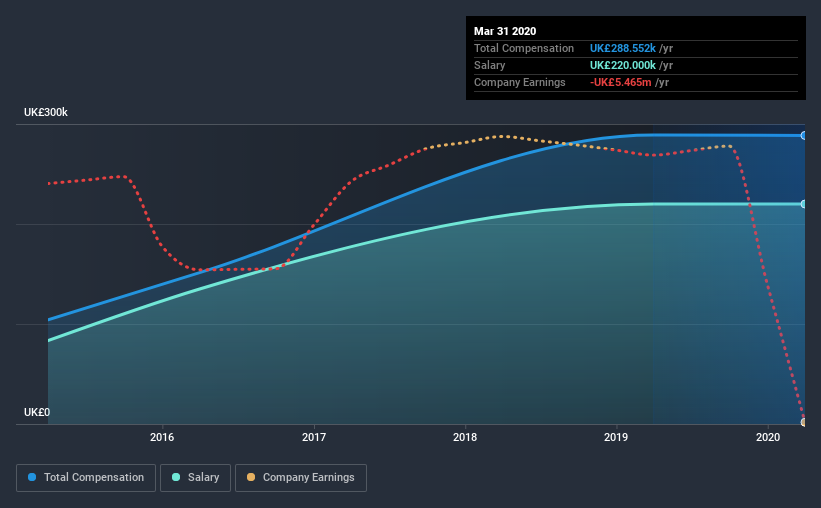

Our data indicates that Tavistock Investments Plc has a market capitalization of UK£14m, and total annual CEO compensation was reported as UK£289k for the year to March 2020. That is, the compensation was roughly the same as last year. Notably, the salary which is UK£220.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below UK£155m, we found that the median total CEO compensation was UK£253k. This suggests that Tavistock Investments remunerates its CEO largely in line with the industry average. What's more, Brian Raven holds UK£1.5m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2020 | 2019 | Proportion (2020) |

Salary | UK£220k | UK£220k | 76% |

Other | UK£69k | UK£69k | 24% |

Total Compensation | UK£289k | UK£289k | 100% |

Talking in terms of the industry, salary represented approximately 49% of total compensation out of all the companies we analyzed, while other remuneration made up 51% of the pie. Tavistock Investments pays out 76% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Tavistock Investments Plc's Growth

Over the last three years, Tavistock Investments Plc has shrunk its earnings per share by 110% per year. Its revenue is up 5.3% over the last year.

The decline in EPS is a bit concerning. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Tavistock Investments Plc Been A Good Investment?

With a three year total loss of 21% for the shareholders, Tavistock Investments Plc would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As previously discussed, Brian is compensated close to the median for companies of its size, and which belong to the same industry. In the meantime, the company has reported declining EPS growth and shareholder returns over the last three years. It's tough to call out the compensation as inappropriate, but shareholders might not favor a raise before company performance improves.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 4 warning signs for Tavistock Investments you should be aware of, and 1 of them is concerning.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance