How Should Investors Feel About Transense Technologies plc's (LON:TRT) CEO Pay?

Harley Graham Storey-MacIntosh is the CEO of Transense Technologies plc (LON:TRT). This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Then we'll look at a snap shot of the business growth. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This method should give us information to assess how appropriately the company pays the CEO.

Check out our latest analysis for Transense Technologies

How Does Harley Graham Storey-MacIntosh's Compensation Compare With Similar Sized Companies?

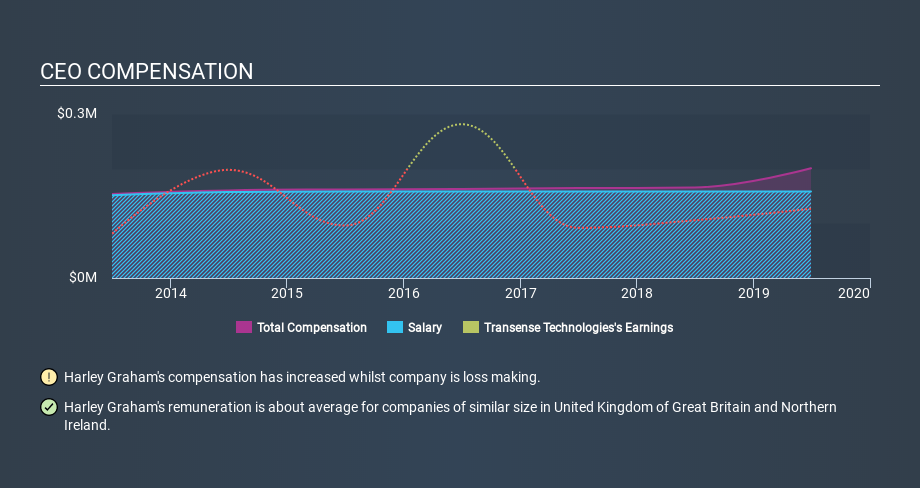

According to our data, Transense Technologies plc has a market capitalization of UK£8.9m, and paid its CEO total annual compensation worth UK£201k over the year to June 2019. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at UK£158k. We looked at a group of companies with market capitalizations under UK£163m, and the median CEO total compensation was UK£275k.

Pay mix tells us a lot about how a company functions versus the wider industry, and it's no different in the case of Transense Technologies. Speaking on an industry level, we can see that nearly 81% of total compensation represents salary, while the remainder of 19% is other remuneration. Our data reveals that Transense Technologies allocates salary in line with the wider market.

So Harley Graham Storey-MacIntosh is paid around the average of the companies we looked at. This doesn't tell us a whole lot on its own, but looking at the performance of the actual business will give us useful context. The graphic below shows how CEO compensation at Transense Technologies has changed from year to year.

Is Transense Technologies plc Growing?

On average over the last three years, Transense Technologies plc has seen earnings per share (EPS) move in a favourable direction by 19% each year (using a line of best fit). In the last year, its revenue is up 18%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's a real positive to see this sort of growth in a single year. That suggests a healthy and growing business. Shareholders might be interested in this free visualization of analyst forecasts.

Has Transense Technologies plc Been A Good Investment?

Since shareholders would have lost about 16% over three years, some Transense Technologies plc shareholders would surely be feeling negative emotions. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Remuneration for Harley Graham Storey-MacIntosh is close enough to the median pay for a CEO of a similar sized company .

We'd say the company can boast of its EPS growth, but we cannot say the same about the lacklustre shareholder returns (over the last three years). Considering the improvement in earnings per share, one could argue that the CEO pay is appropriate, albeit not too low. On another note, Transense Technologies has 5 warning signs (and 1 which is a bit concerning) we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance